Long time lurker that is looking for some feedback.

Scenario: Married, 46 & DW 46. Three kids with college starting in 3 years for the 1st one, then the others will follow starting every three years thereafter – 2019, 2021 & 2023. I am looking to be FI in the next 2~3 years – take time off, retire, reboot, etc.. Wife is still enjoying work and would most likely continue for the next 7~10 years.

SALARY: 190k- gross

ME: 120k

WIFE: 70k

ASSETS: 1.6M (excluding home equity)

CASH: 25K

INVESTMENT REAL ESTATE: 250k (free and clear)

Net Cash Flow: 20k / YR

TAXABLE ACCOUNTS: 542k

(majority of dollars assigned to Vanguard Index funds)

* US Stocks – 59% 318k

* REITs – 14% 77k

* INTL – 11% 58k

* US Bonds – 13% 57k

RETIREMENT: 694k

-breakdown-

ROTH IRA: 201k

(majority of the dollars assigned to Vanguard Index funds)

* US Stocks – 72% 145k

* INTL – 13% 26k

* REIT – 6% 12k

* Bonds – 8% 17k

IRA: 176k

(majority of the dollars assigned to Vanguard Index funds)

* US Stocks – 58% 102k

* INTL – 16% 28k

* REIT – 6% 8k

* Bonds – 20% 35k

401k: 316k

(majority fidelity index)

* US Stocks – 74% 233k

* INTL – 14% 45k

* REIT – 5% 15k

* Bonds – 5% 16k

Education: 160k

* 529s: 160k

(Target date funds)

PENSION&SS: 70K / YR @ 65 for both of us

* WIFE: 55K

* ME: 15K

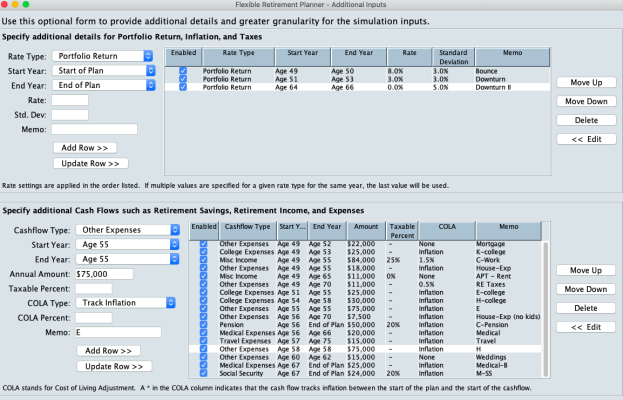

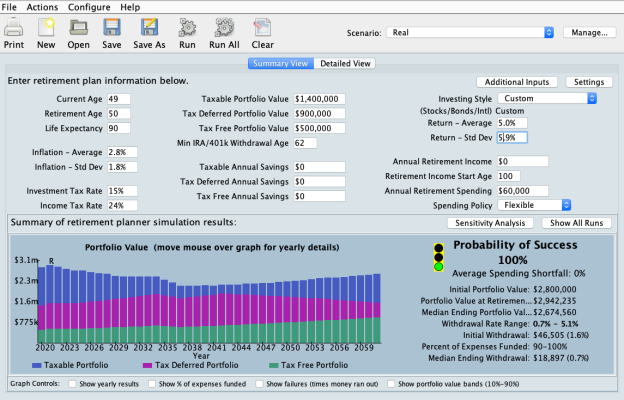

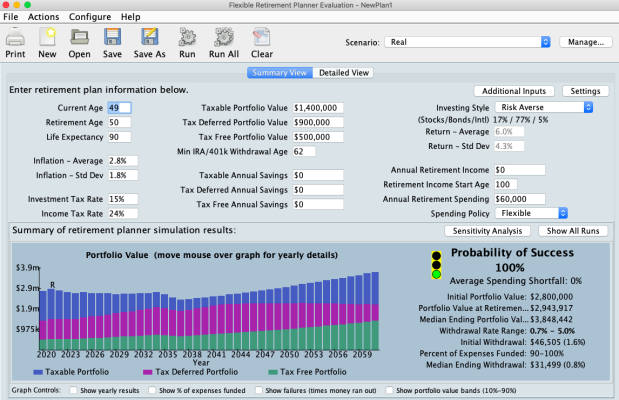

I’ve used a number of online tools in the past few years and all point positively. Personal Capital is one that I gravitate to more and more since it allows for granular settings of Income/Expense buckets (College costs, Health Care, Selling RE, etc..) and it reports back a success 92~95% (8.9% annualized return with a 14% std. deviation. 8.9% is a little high in my book so I assume at least a 1% reduction in the success number).

Expense wise (which is everything…) we run between 90~110k per year (past two years). Based on that I have assumed that we’ll need 40~50k from assets until wife retires which we would then increase to 100k until SS&Pension.

As for investment style and risk tolerance I am a contrarian/index/long term investor.

Questions:

* With these numbers would you feel comfortable in hanging it up in 2~3 years?

* Outside of continuing to max out retirement accounts, where would you apply additional savings taking into account wanting to be FI- cash, bonds, equities? Expectation is at least 30~40k/YR available for this purpose while i work.

* Thoughts on dealing with gap years, until SS&Pension kick in, work from cash holdings or try to live off of dividends, both, etc..?.? Right now I feel i am not setup to deal with this aspect.

Thanks for your time…

Scenario: Married, 46 & DW 46. Three kids with college starting in 3 years for the 1st one, then the others will follow starting every three years thereafter – 2019, 2021 & 2023. I am looking to be FI in the next 2~3 years – take time off, retire, reboot, etc.. Wife is still enjoying work and would most likely continue for the next 7~10 years.

SALARY: 190k- gross

ME: 120k

WIFE: 70k

ASSETS: 1.6M (excluding home equity)

CASH: 25K

INVESTMENT REAL ESTATE: 250k (free and clear)

Net Cash Flow: 20k / YR

TAXABLE ACCOUNTS: 542k

(majority of dollars assigned to Vanguard Index funds)

* US Stocks – 59% 318k

* REITs – 14% 77k

* INTL – 11% 58k

* US Bonds – 13% 57k

RETIREMENT: 694k

-breakdown-

ROTH IRA: 201k

(majority of the dollars assigned to Vanguard Index funds)

* US Stocks – 72% 145k

* INTL – 13% 26k

* REIT – 6% 12k

* Bonds – 8% 17k

IRA: 176k

(majority of the dollars assigned to Vanguard Index funds)

* US Stocks – 58% 102k

* INTL – 16% 28k

* REIT – 6% 8k

* Bonds – 20% 35k

401k: 316k

(majority fidelity index)

* US Stocks – 74% 233k

* INTL – 14% 45k

* REIT – 5% 15k

* Bonds – 5% 16k

Education: 160k

* 529s: 160k

(Target date funds)

PENSION&SS: 70K / YR @ 65 for both of us

* WIFE: 55K

* ME: 15K

I’ve used a number of online tools in the past few years and all point positively. Personal Capital is one that I gravitate to more and more since it allows for granular settings of Income/Expense buckets (College costs, Health Care, Selling RE, etc..) and it reports back a success 92~95% (8.9% annualized return with a 14% std. deviation. 8.9% is a little high in my book so I assume at least a 1% reduction in the success number).

Expense wise (which is everything…) we run between 90~110k per year (past two years). Based on that I have assumed that we’ll need 40~50k from assets until wife retires which we would then increase to 100k until SS&Pension.

As for investment style and risk tolerance I am a contrarian/index/long term investor.

Questions:

* With these numbers would you feel comfortable in hanging it up in 2~3 years?

* Outside of continuing to max out retirement accounts, where would you apply additional savings taking into account wanting to be FI- cash, bonds, equities? Expectation is at least 30~40k/YR available for this purpose while i work.

* Thoughts on dealing with gap years, until SS&Pension kick in, work from cash holdings or try to live off of dividends, both, etc..?.? Right now I feel i am not setup to deal with this aspect.

Thanks for your time…