Exit 2024

Recycles dryer sheets

- Joined

- Jun 23, 2015

- Messages

- 414

Hello everyone!!!

I have been lurker here for quite some time and finally decided to register and introduce myself

We are family of 3 with child currently in college (3 more years to go).

Both husband and wife are age 46 and actively planning to exit workforce no later then July 2024 - age 55.

Finding this wonderful forum was a blessing for us - we finally think that we have the target and the plan

We are both employed by megacorp and make together about $250k.

We have records of all our spendings in Quicken going back to 1999 - so have pretty good idea what we really need.

Below is our details - hope to solicit some feedback

Spending plan - very rough numbers and represent worst case scenario by todays assesment

Living expenses including some travel - $50k/year (has some fluff included)

Healthcare for 2 - $20k/year (apprised at local exchange for age 55, added 30% inflation, no subsidy)

Taxes - $20k/year

Total - $90k (or less)

Net worth target - looking at $3mil (is that even realistic ? )

)

That will include RE that will be paid off - about $300k

Investable assets - $ 2.7mil or 30 x spending, WR ~3.3% (too conservative? )

)

We are in good health and have relatives living into their late 90s

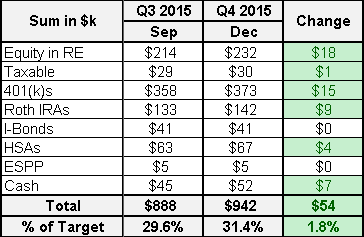

Current state as of 7/31/2015

Equity in RE - $211k

Taxable - $32k

401(k)s - $385k

Roth IRAs - $133k

I-Bonds - $41k

HSAs - $61k

ESPP - $8k (we cash it out every 3 months)

Cash - $41k

Total - $912k

We are really hoping to join 2 comma club by end of the year, but that will require some market cooperation also

I plan to use this thread to post updates on our way to exit 2024 and ask questions as they will arise

Thanks for reading and looking forward to be part of this amazing community

I have been lurker here for quite some time and finally decided to register and introduce myself

We are family of 3 with child currently in college (3 more years to go).

Both husband and wife are age 46 and actively planning to exit workforce no later then July 2024 - age 55.

Finding this wonderful forum was a blessing for us - we finally think that we have the target and the plan

We are both employed by megacorp and make together about $250k.

We have records of all our spendings in Quicken going back to 1999 - so have pretty good idea what we really need.

Below is our details - hope to solicit some feedback

Spending plan - very rough numbers and represent worst case scenario by todays assesment

Living expenses including some travel - $50k/year (has some fluff included)

Healthcare for 2 - $20k/year (apprised at local exchange for age 55, added 30% inflation, no subsidy)

Taxes - $20k/year

Total - $90k (or less)

Net worth target - looking at $3mil (is that even realistic ?

That will include RE that will be paid off - about $300k

Investable assets - $ 2.7mil or 30 x spending, WR ~3.3% (too conservative?

We are in good health and have relatives living into their late 90s

Current state as of 7/31/2015

Equity in RE - $211k

Taxable - $32k

401(k)s - $385k

Roth IRAs - $133k

I-Bonds - $41k

HSAs - $61k

ESPP - $8k (we cash it out every 3 months)

Cash - $41k

Total - $912k

We are really hoping to join 2 comma club by end of the year, but that will require some market cooperation also

I plan to use this thread to post updates on our way to exit 2024 and ask questions as they will arise

Thanks for reading and looking forward to be part of this amazing community

Last edited:

federal, state, FICA, local

federal, state, FICA, local we have condo potentially to sell or rent to aid that $90k/year inflation erosion but still may need a better plan

we have condo potentially to sell or rent to aid that $90k/year inflation erosion but still may need a better plan