Hello All,

My wife and I are both employed at the same business in a declining industry(work for family business). My wife also holds a night job several nights per week. I am 43, wife is 41. House is paid off. We live in the land of incarcerated governors(illinois), so our property taxes are quite high for a very average house. We bring in around $90k + about $20k from her second job. Net worth is about 1.1million with about 650k in retirement assets...the rest is house, cars, etc. We have no kids.

We would like to retire by 55. The business is on shaky ground as is the industry(printing). We are hoping to hold on for another 15 years which is pretty optimistic for the industry and highly optimistic for our family business. We both put in about 10k each in our 401 and another 5k each in a roth ira.

Investing wise, we are about 90%+ in stock mutual funds with a quite high % in overseas/emerging markets.

My questions are as follows...we have nearly nothing saved in non-retirement accounts...can start working on this as our house has just been paid off. We need some repairs at this point...maybe 20k worth. Would it be worth taking out a loan or should we get on a cash only plan now?

I had also thought about getting a loan for about 100k and investing what we don't need for repairs...wife hates this plan.

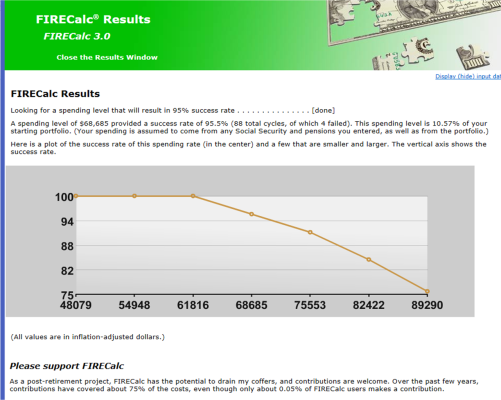

Is my investing plan and current savings schedule going to work? My wife is diabetic, so insurance between retirement and medicare frighten me.

Been lurking this site for a while now, thanks for taking time to read my post!

My wife and I are both employed at the same business in a declining industry(work for family business). My wife also holds a night job several nights per week. I am 43, wife is 41. House is paid off. We live in the land of incarcerated governors(illinois), so our property taxes are quite high for a very average house. We bring in around $90k + about $20k from her second job. Net worth is about 1.1million with about 650k in retirement assets...the rest is house, cars, etc. We have no kids.

We would like to retire by 55. The business is on shaky ground as is the industry(printing). We are hoping to hold on for another 15 years which is pretty optimistic for the industry and highly optimistic for our family business. We both put in about 10k each in our 401 and another 5k each in a roth ira.

Investing wise, we are about 90%+ in stock mutual funds with a quite high % in overseas/emerging markets.

My questions are as follows...we have nearly nothing saved in non-retirement accounts...can start working on this as our house has just been paid off. We need some repairs at this point...maybe 20k worth. Would it be worth taking out a loan or should we get on a cash only plan now?

I had also thought about getting a loan for about 100k and investing what we don't need for repairs...wife hates this plan.

Is my investing plan and current savings schedule going to work? My wife is diabetic, so insurance between retirement and medicare frighten me.

Been lurking this site for a while now, thanks for taking time to read my post!