Now you have to split that return with the nice members of the forum who helped bring attention to the matter...'

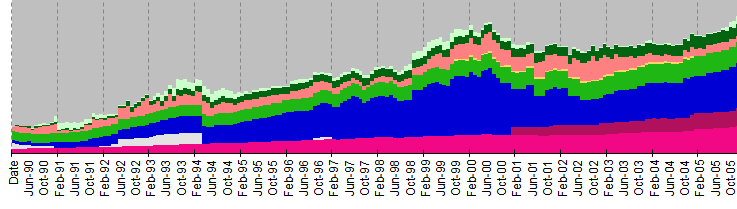

When I joined E-R, I was about your age. The picture below shows where we were at. The times for us felt like that picture, not very pretty. There was no way we could early retire with our investments, pension, SS, etc. However, I decided to go with 25% contributions in 401k. Also, started Roth accounts for two of us.

Fortunately for us, there was a recession at the time, and we invested at fire-sale prices. Still, it took discipline to continue as the total continued to drop. Thirteen years later, I can see the results. Still working, but not really hating the job, and much happier with life.

The key is regular investing, pay yourself first, or whatever works for you. Open a Roth, and have $$$ deducted monthly.

Find a way to love the job and what it provides to you monthly. Ride it til the end.

BTW, I won't retire early, but since 2015 it has felt like retirement, but they pay me a lot for my experience and attitude.

Good luck!