Sandy & Shirley

Recycles dryer sheets

Most of the Break Even posts that I see are based on the Gross Social Security Benefits that you receive from the government. Some are adjusted for inflation and other things, but I prefer to do my calculations based on the “NET” amount of benefits after taxes based on ALL of the income that you need to reach your desired lifestyle.

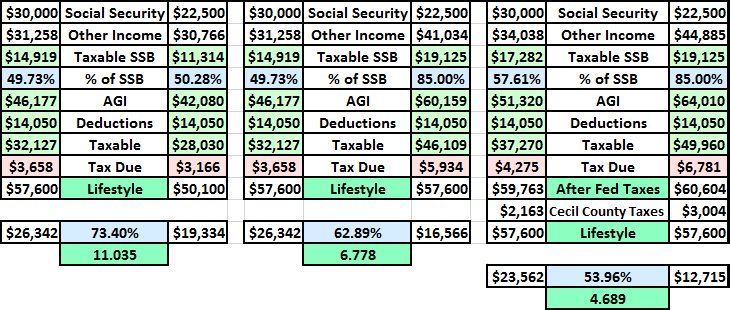

The following examples are based on an individual with an average inflation adjusted income of about $76,800 which will give that individual a PIA (Primary Insurance Amount) of $2,500 a month if they retire at exactly their Full Retirement Age. Their yearly benefits would total a nice round $30,000. They would get 75% of that benefit if they decided to retire 4 year early, a yearly total of $22,500.

The first 3 columns of the following example makes the assumption that this individual wants to retire on 75% of their pre-retirement income, $57,600 after tax! I SWAGed (Scientific Wild “Arithmetic” Guess)ed at the other income (taxable) necessary to reach their desired after tax lifestyle. Since the third column represents the $7,500 smaller Social Security benefit they have chosen to receive, I also reduced their after tax lifestyle by that same amount. The calculation at the bottom compares their Net Government Income, Social Security minus taxes. They are only getting 73.4 cents per dollar so their break even is about 11 years and 1 month, which is fairly close to the 12 year break even that everyone talks about when your gross benefits are 75 cents per dollar.

I then re-did the tax calculations based on the assumption that this individual did not wish to reduce their desired retirement lifestyle to adjust for the lower Social Security benefits. This caused a significant increase in the amount of additional Other Taxable Income necessary and a parallel increase in the amount of Taxable Social Security up to its 85% maximum limit, all of which increased total taxes due by almost $2,800. The net government income calculation at the bottom shows a significant drop of only 62.89 cents per dollar with a break even reduction to only 6 years and 10 months.

The final three columns include the State and local taxes for Cecil County Maryland which brings the net government break even down to only 4 years and 8 months.

None of these calculations take into account where the money will come from while you wait the extra 4 years before you start your Social Security Benefits. The real issue is should you calculate your break even point only on the Gross Income that your are getting from Social Security, or the Net Income after the government takes some of that money back as taxes.

If you are willing to get a smaller benefit, are you also willing to live a lower lifestyle?

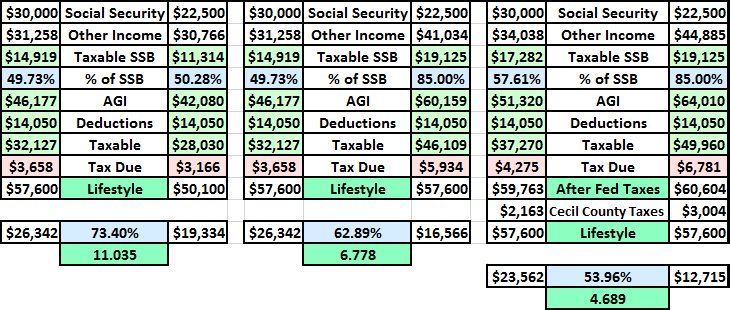

The following examples are based on an individual with an average inflation adjusted income of about $76,800 which will give that individual a PIA (Primary Insurance Amount) of $2,500 a month if they retire at exactly their Full Retirement Age. Their yearly benefits would total a nice round $30,000. They would get 75% of that benefit if they decided to retire 4 year early, a yearly total of $22,500.

The first 3 columns of the following example makes the assumption that this individual wants to retire on 75% of their pre-retirement income, $57,600 after tax! I SWAGed (Scientific Wild “Arithmetic” Guess)ed at the other income (taxable) necessary to reach their desired after tax lifestyle. Since the third column represents the $7,500 smaller Social Security benefit they have chosen to receive, I also reduced their after tax lifestyle by that same amount. The calculation at the bottom compares their Net Government Income, Social Security minus taxes. They are only getting 73.4 cents per dollar so their break even is about 11 years and 1 month, which is fairly close to the 12 year break even that everyone talks about when your gross benefits are 75 cents per dollar.

I then re-did the tax calculations based on the assumption that this individual did not wish to reduce their desired retirement lifestyle to adjust for the lower Social Security benefits. This caused a significant increase in the amount of additional Other Taxable Income necessary and a parallel increase in the amount of Taxable Social Security up to its 85% maximum limit, all of which increased total taxes due by almost $2,800. The net government income calculation at the bottom shows a significant drop of only 62.89 cents per dollar with a break even reduction to only 6 years and 10 months.

The final three columns include the State and local taxes for Cecil County Maryland which brings the net government break even down to only 4 years and 8 months.

None of these calculations take into account where the money will come from while you wait the extra 4 years before you start your Social Security Benefits. The real issue is should you calculate your break even point only on the Gross Income that your are getting from Social Security, or the Net Income after the government takes some of that money back as taxes.

If you are willing to get a smaller benefit, are you also willing to live a lower lifestyle?