I always scratch my head about how stay-the-course investors, like me, think they will realistically take advantage of future low prices. To do so, an investor must be either:

1). Still working, saving and, therefore, dollar cost averaging new money into the markets. Fine, I get it. I did this too.

2) Inefficiently sitting on a pile of unused cash. However, are there really such conservative market timers who stock up on do-nothing cash in amounts large enough to make much of a difference when deployed in a dip? Maybe so. Emotionally, in reality, a lot of people are going to appreciate their cash stash at such insecure times and won’t want to let go of it. In bull markets, conversely, such investors will miss out on growth due to a cash lag, thus evening out their returns long term.

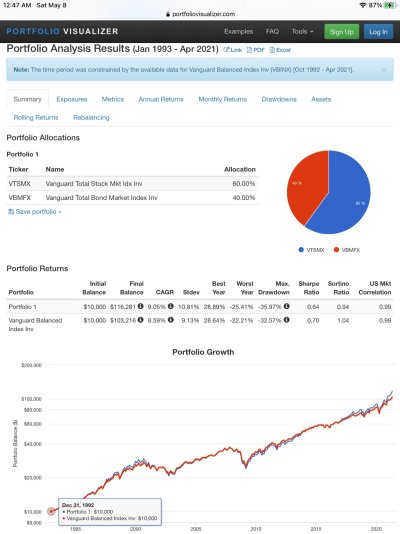

3) Willing to rebalance from a more conservative allocation in bonds into a more aggressive position in stocks during the frightening teeth of what one hopes is the bear market trough. Such a person must be changing up their asset allocation, because if they keep their original AA, the rebalance at the trough would have made virtually zero difference later on in their net worth vs. just doing what they always do. Adopting a more aggressive AA is also a form of market timing vs. “stay the course.”

4) Something else, in which case, please teach me.