With a little too much time on my hands, delving into philosophical subjects is a side hobby. This time, the subject is Income. What it means, how it is defined, how the interpretation affects us, and whether or not there are iniquities in the application of laws that use the term.

For argument sake, assume that you are 50 years old, have inherited 4 million dollars, and plan to spend $100,000/yr. for the rest of your life. Theoretically, you would likely never have to pay income tax again. (leave off the inflation bit..)

By the same token, if Warren Buffet bequeathed his fortune to every member of his extended family, two generations hence, not one single person would ever have to work, contribute to society in any way, or... ever pay income taxes.

In my own state of Illinois, (until very recently), a multi millionaire could collect subsidies of thousands of dollars in healthcare assistance, and do it legally, since the criterion for this subsidy was income.

From here:income legal definition of income. income synonyms by the Free Online Law Dictionary.

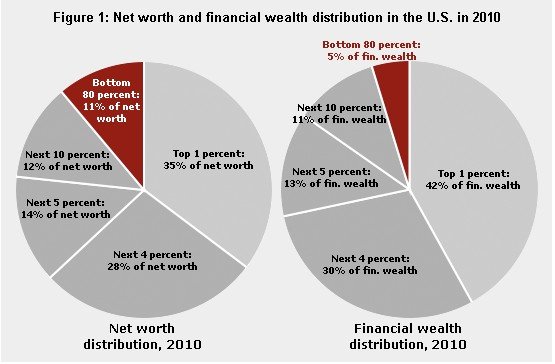

Purely as a matter for discussion, what would you think of using wealth (net worth) as a basis for taxation, rather than income?

For argument sake, assume that you are 50 years old, have inherited 4 million dollars, and plan to spend $100,000/yr. for the rest of your life. Theoretically, you would likely never have to pay income tax again. (leave off the inflation bit..)

By the same token, if Warren Buffet bequeathed his fortune to every member of his extended family, two generations hence, not one single person would ever have to work, contribute to society in any way, or... ever pay income taxes.

In my own state of Illinois, (until very recently), a multi millionaire could collect subsidies of thousands of dollars in healthcare assistance, and do it legally, since the criterion for this subsidy was income.

From here:income legal definition of income. income synonyms by the Free Online Law Dictionary.

....................................................................Income

The return in money from one's business, labor, or capital invested; gains, profits, salary, wages, etc.

The gain derived from capital, from labor or effort, or both combined, including profit or gain through sale or conversion of capital. Income is not a gain accruing to capital or a growth in the value of the investment, but is a profit, something of exchangeable value, proceeding from the property and being received or drawn by the recipient for separate use, benefit, and disposal. That which comes in or is received from any business, or investment of capital, without reference to outgoing expenditures.

.................................................................................

Income

income n. money, goods or other economic benefit received. Under income tax laws, income can be "active" through one's efforts or work (including management), or "passive" from rentals, stock dividends, investments and interest on deposits in which there is neither physical effort nor management. For tax purposes, income does not include gifts and inheritances received. Taxes are collected based on income by the federal government and most state governments.

Purely as a matter for discussion, what would you think of using wealth (net worth) as a basis for taxation, rather than income?

Last edited: