Fedup

Thinks s/he gets paid by the post

I don't have to worry about ACA credit. At most I have to worry about Medicare part B payment. Too high then my husband might have to pay more.

I don't know what your situation is but I try to keep in mind that our tax situation in later years could be "better"--due to some very unfortunate turns of events (terrible long-term investment returns or unavoidable spending that leaves our accounts a lot lower than they are today, etc). If that happens and we find ourselves with very low withdrawals, very low income, and a zero or very low tax rate, I'm going to be very unhappy if I voluntarily paid higher tax rates earlier when we could really use that money to meet expenses. Paying more taxes when we are a decade or two closer to the finish line (and uncertainty is lower) is better than paying them earlier when the road ahead (and uncertainties) are greater.That's the point. It's not like our tax situation is going to be better in years later.

I mean what choice do we have if we don't convert? Marginal tax rate means nothing.

For me, that means I have to create multiple scenarios from many different age points and simulate using TT.

I've done some cases, but it doesn't look like I will be able to exhaust the taxable account easily.

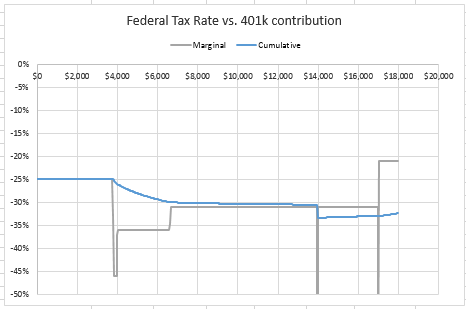

If a person plans to withdraw $250K every year, then this "hump" is inconsequential. As pointed out in the OP, this "hump" is only significant (and can probably only be effectively dealt with) if your planned taxable income is close to the same level as the "hump."

It's a shame that the tax programs don't include some sort of graph like this. They could also tell you (for planning purposes, and/or Roth re-characterization reviews) what would be the effect of a $100 change in various forms of deductions and income.

Charts like those in the OP would be helpful....

You could forfeit up to $6,444 in EITC if you go over the Investment Income Limit by $0.01.

https://www.irs.gov/credits-deducti...ncome-limits-maximum-credit-amounts-next-year

So that's a 64,440,000% (sixty four million four hundred and forty thousand percent) tax bracket!

There are plenty of examples like this. Watch out.