Sandy & Shirley

Recycles dryer sheets

This is a copy of my original post where the images were not properly displayed.

In my opinion, Marginal Tax Rates are an extremely important concept that many of us need to understand while preparing for and living in retirement.

I am 70 and when I talk to my friends about the 55.5% and 46.25% Federal Tax Brackets almost all of them have the same response, “I don’t make anywhere near that amount of money”! When I tell them that those tax rates start at gross income levels of 50 to 60 thousand dollars, they are shocked and very interested in learning more. So I am bringing to this group the things that I talk to my friends about.

These extreme tax rates are caused by what I like to call the Parallel Taxation of your Parallel Taxation.

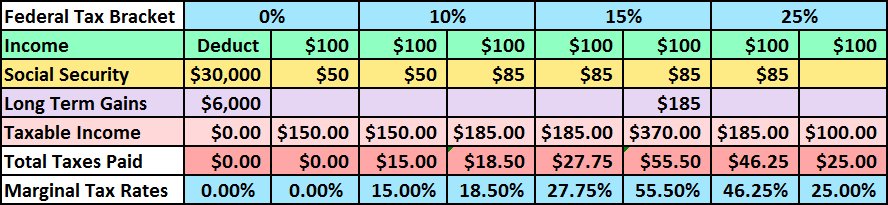

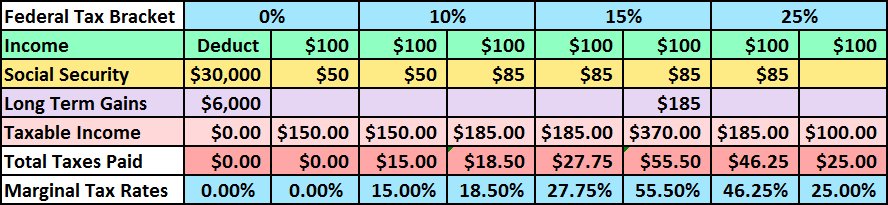

Looking at the worse case in this chart, at the top end of the 15% Federal Tax Bracket, when you earn or withdraw $100 of taxable income it causes $85 of your tax deferred Social Security to also become taxable income which causes the combined $185 of your tax deferred Long Term Gains to also become taxable income at the same 15% level. That is a total of a $370 increase in your taxable income at 15%, $55.50, which is 55.5% of the actual $100 increase in your income. A marginal tax rate is the amount of additional tax paid on an additional dollar of income.

I used an Excel spreadsheet to prepare the 3 graphs that I am about to use to illustrate this concept to the members of this forum.

Using the published 2017 federal tax brackets and deductions, this first graph shows the marginal rates paid by a single individual who is getting $30,000 from Social Security, $6,000 from LTCGs, plus other income from taxable sources like TIRA withdrawals or MRDs.

The graph is divided into 4 sections as illustrated by the numbers under the graph.

Due to the deferred taxation of Social Security and LTCGs, for about the first $45,280 of gross income, the retired individual is paying zero taxes while a working individual at the same $45,280 income level with no LTCGs would pay about $4,533 in Federal Tax.

This is where the “Marginal” tax rates start. The parallel sources of the “Marginal” rates are represented by the 3 dotted lines in the graph: Red for your normal tax bracket, plus Green for the taxation of your Social Security Benefits, plus Blue for the taxation of your Long Term Capital Gains. Every dollar of income can cause multiple income sources to be taxed at the same time, in parallel!

During the next $17,720 of your taxable retirement income, the solid red marginal brackets are close to the dashed blue standard brackets, a retired individual is paying about the same in taxes as a working individual during this income range. In this illustration only about $288 of the $4,533 of tax savings is given back to the IRS.

Everything changes drastically at the $63,000 gross income level. The solid red line definitely illustrates why I call the marginal tax rates paid over the next $10,240 “The Hump”. During this income range a working individual is in the 25% bracket and pays $2,560 in federal taxes while the retired individual is in the 55.5% and 46.25% marginal brackets and pays $5,080 in federal taxes giving $2,520 of their tax savings back to the IRS.

Once 85% of your Social Security has been taxed, all of the parallel taxation stops and everyone is back in the 25% Federal Tax Bracket. At this point you can just look back over your shoulder and say that 15% of your Social Security was tax free for a savings of $1,125 and your LTCGs were only taxed at 15% for another savings of $600.

The question to the group is simple, do you want to save $4,533 or $1,725?

As we will see shortly, all of these numbers are totally dependent on the size of your Social Security Benefit and the sources of your other income. You could use a spreadsheet or other tool to give you a nice picture of what happens, but that is not necessary for doing your retirement planning. If your Social Security benefit is above $18,000 The Hump starts at the 25% federal bracket, either as your LTCGs are pushed into that bracket, 55.5%, or when your taxable income reaches that bracket, 46.25%. All you have to do is treat any long term gains or dividends as ordinary taxable income and calculate your tax bracket. If you are close to the 25% bracket, see what you can do to change your income sources from taxable to non-taxable.

The Marriage Penalty

OK, we have seen how this effects a retired individual who is single. There is still a marriage penalty when retired because the taxability of your Social Security benefits starts when half of your benefits plus your other income reaches $25,000 for a single person and only $32,000 for a married couple, not $50,000 as it would be for 2 single individuals.

The gross income scale on the graph represents per-capita income. Note how the married couple, green line, starts paying taxes earlier because their joint taxable income is increasing faster. Their marginal rate starts at 18.5% because they are already in their 85% taxability bracket before their income reaches the 10% federal tax bracket. Since they started paying taxes earlier, they saved less taxes so their Tax Hump is therefore smaller because they have less to give back to the IRS.

The numbers above the graph and the tick marks on the graph illustrate the per capita income levels where The Humps start. The first set of numbers under the graph illustrate what happens when other income is doubled. The married couple is now paying their full Hump tax while the single individual is not. When the per capita gross income levels are pushed to $74,000 everyone is over the hump and is paying close to the same tax rate. A small difference still remains because the over 65 addition to standard deductions is $300 more for a single individual.

Your Social Security level defines The Hump

The red line illustrates how a lower Social Security Benefit gives you less tax deferred income which makes you start paying taxes at a lower gross income level which saves you less taxes which makes your hump smaller because you have less to give back.

This post is aimed at a very specific segment of the retired population. If you have a great pension plan and you are “Over The Hump” it can show you how you got to your after tax retirement income level, but does nothing to help you change it. If your retirement income level is small just about anything you can do could easily be counter productive.

If your retirement income is going to put you at, near, or slightly into “The Hump”, knowing the marginal tax brackets you could be facing can help you to plan for and take steps to avoid paying those ultra high tax rates.

In my opinion, Marginal Tax Rates are an extremely important concept that many of us need to understand while preparing for and living in retirement.

I am 70 and when I talk to my friends about the 55.5% and 46.25% Federal Tax Brackets almost all of them have the same response, “I don’t make anywhere near that amount of money”! When I tell them that those tax rates start at gross income levels of 50 to 60 thousand dollars, they are shocked and very interested in learning more. So I am bringing to this group the things that I talk to my friends about.

These extreme tax rates are caused by what I like to call the Parallel Taxation of your Parallel Taxation.

Looking at the worse case in this chart, at the top end of the 15% Federal Tax Bracket, when you earn or withdraw $100 of taxable income it causes $85 of your tax deferred Social Security to also become taxable income which causes the combined $185 of your tax deferred Long Term Gains to also become taxable income at the same 15% level. That is a total of a $370 increase in your taxable income at 15%, $55.50, which is 55.5% of the actual $100 increase in your income. A marginal tax rate is the amount of additional tax paid on an additional dollar of income.

I used an Excel spreadsheet to prepare the 3 graphs that I am about to use to illustrate this concept to the members of this forum.

Using the published 2017 federal tax brackets and deductions, this first graph shows the marginal rates paid by a single individual who is getting $30,000 from Social Security, $6,000 from LTCGs, plus other income from taxable sources like TIRA withdrawals or MRDs.

The graph is divided into 4 sections as illustrated by the numbers under the graph.

Due to the deferred taxation of Social Security and LTCGs, for about the first $45,280 of gross income, the retired individual is paying zero taxes while a working individual at the same $45,280 income level with no LTCGs would pay about $4,533 in Federal Tax.

This is where the “Marginal” tax rates start. The parallel sources of the “Marginal” rates are represented by the 3 dotted lines in the graph: Red for your normal tax bracket, plus Green for the taxation of your Social Security Benefits, plus Blue for the taxation of your Long Term Capital Gains. Every dollar of income can cause multiple income sources to be taxed at the same time, in parallel!

During the next $17,720 of your taxable retirement income, the solid red marginal brackets are close to the dashed blue standard brackets, a retired individual is paying about the same in taxes as a working individual during this income range. In this illustration only about $288 of the $4,533 of tax savings is given back to the IRS.

Everything changes drastically at the $63,000 gross income level. The solid red line definitely illustrates why I call the marginal tax rates paid over the next $10,240 “The Hump”. During this income range a working individual is in the 25% bracket and pays $2,560 in federal taxes while the retired individual is in the 55.5% and 46.25% marginal brackets and pays $5,080 in federal taxes giving $2,520 of their tax savings back to the IRS.

Once 85% of your Social Security has been taxed, all of the parallel taxation stops and everyone is back in the 25% Federal Tax Bracket. At this point you can just look back over your shoulder and say that 15% of your Social Security was tax free for a savings of $1,125 and your LTCGs were only taxed at 15% for another savings of $600.

The question to the group is simple, do you want to save $4,533 or $1,725?

As we will see shortly, all of these numbers are totally dependent on the size of your Social Security Benefit and the sources of your other income. You could use a spreadsheet or other tool to give you a nice picture of what happens, but that is not necessary for doing your retirement planning. If your Social Security benefit is above $18,000 The Hump starts at the 25% federal bracket, either as your LTCGs are pushed into that bracket, 55.5%, or when your taxable income reaches that bracket, 46.25%. All you have to do is treat any long term gains or dividends as ordinary taxable income and calculate your tax bracket. If you are close to the 25% bracket, see what you can do to change your income sources from taxable to non-taxable.

The Marriage Penalty

OK, we have seen how this effects a retired individual who is single. There is still a marriage penalty when retired because the taxability of your Social Security benefits starts when half of your benefits plus your other income reaches $25,000 for a single person and only $32,000 for a married couple, not $50,000 as it would be for 2 single individuals.

The gross income scale on the graph represents per-capita income. Note how the married couple, green line, starts paying taxes earlier because their joint taxable income is increasing faster. Their marginal rate starts at 18.5% because they are already in their 85% taxability bracket before their income reaches the 10% federal tax bracket. Since they started paying taxes earlier, they saved less taxes so their Tax Hump is therefore smaller because they have less to give back to the IRS.

The numbers above the graph and the tick marks on the graph illustrate the per capita income levels where The Humps start. The first set of numbers under the graph illustrate what happens when other income is doubled. The married couple is now paying their full Hump tax while the single individual is not. When the per capita gross income levels are pushed to $74,000 everyone is over the hump and is paying close to the same tax rate. A small difference still remains because the over 65 addition to standard deductions is $300 more for a single individual.

Your Social Security level defines The Hump

The red line illustrates how a lower Social Security Benefit gives you less tax deferred income which makes you start paying taxes at a lower gross income level which saves you less taxes which makes your hump smaller because you have less to give back.

This post is aimed at a very specific segment of the retired population. If you have a great pension plan and you are “Over The Hump” it can show you how you got to your after tax retirement income level, but does nothing to help you change it. If your retirement income level is small just about anything you can do could easily be counter productive.

If your retirement income is going to put you at, near, or slightly into “The Hump”, knowing the marginal tax brackets you could be facing can help you to plan for and take steps to avoid paying those ultra high tax rates.