I suggest making a simple spreadsheet from IRS pub 915. It's only 19 lines long and not complex.

If line 6, 8, or 12 is 0, your SS benefit is not taxable and you can increase income (from MRDs or whatever) until it gets above 0 with no bump in the marginal tax rate.

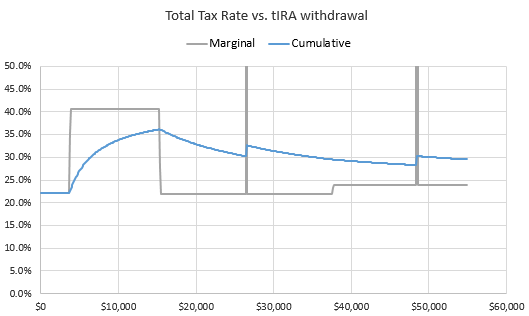

If line 15 is smaller than line 14, you're being taxed on 50% of some of your SS. Every $100 of income you add will push an extra $50 of SS benefits into being taxed until line 15 = line 14. So your marginal tax rate in that range goes up 50%, probably from 12% to 18%.

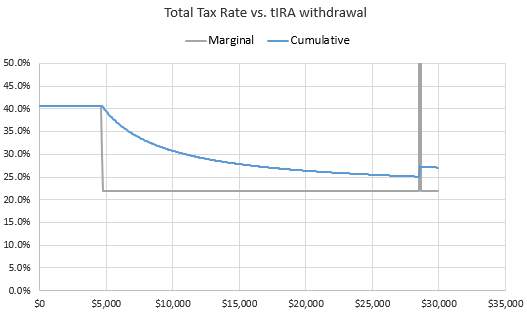

After line 14=line 15, if line 19 is less than line 18, you're being taxed on 85% of some of your SS. Every $100 of income you add push an extra $85 of income into being taxed until lines 18 and 19 are equal. So your marginal tax rate goes up 85%, from 12% to $22.2% or 22% to 40.7%.

Once line 18 = line 19, your SS benefits are taxed to the max, so the marginal rate drops back down.

Making the spreadsheet lets you play with numbers to see how different MRD levels affect your marginal rate, and also what happens if you take your SS benefits at any point between 62 and 70. You can also keep adding income to see how long you stay in the hump.

I see a lot of people say "I'm in the 12% bracket now and will be in retirement even with MRDs, so why should I bother converting now?" The answer might be that your marginal rate for some of the MRDs might be a lot more than 12%.

The marginal rate in any case can be further compounded if you are pushing LTCGs and QDivs into being taxed.

Thanks RunningBum, that is a good form to look at. Since I am a computer geek, the math is simple on that form, so I might try to create the spreadsheet and publish the formulas for everyone to copy.

Line 11 of Publication 915 is very interesting, “Enter $12,000 if married filing jointly; $9,000 if single…”!

A very interesting way of stating the second half of the Social Security “Marriage Penalty”!

The “Basis” for the taxability of your benefits is the same if you are married or single, half of your SSB (lines 1 and 2) plus your other taxable income (lines 3 thru 8).

The first half of the marriage penalty is shown on line 9, enter $32,000 if you are married filing jointly or $25,000 if you are single.

Line 11 is another way of saying that 85% taxability starts at $44,000 for a married couple and $34,000 if you are single.

Since the married couple gets more of their benefits tax free from line 9 ($32,000) than the single individual does ($25,000), why is this a Marriage “Penalty”? The $32,000 requires that you are filing “jointly”, two people. If two individuals are domestic partners, like we are, the combined taxation of our combined benefits starts at $50,000, $25,000 each.

Here is the some data on the penalty for a married couple vs a domestic couple with each couple getting a combined SSB of $50,000, $25,000 per individual:

| From | To | Size | Married | Taxable | Single | Taxable |

| $32,000 | $44,000 | $12,000 | 50% | $6,000 | 0% | $0 |

| $44,000 | $50,000 | $6,000 | 85% | $5,100 | 0% | $0 |

| $50,000 | $68,000 | $18,000 | 85% | $15,300 | 50% | $9,000 |

| | | | $26,400 | | $9,000 |

| $68,000 | $86,941 | $18,941 | 85% | $16,100 | | |

| $68,000 | $107,412 | $39,412 | | | 85% | $33,500 |

| | | | $42,500 | | $42,500 |

| | | | | | |

The penalty is not the total amount of taxable SSB on the last line, the penalty is that a married couple’s benefits become taxable at lower income levels. They are being taxed on $11,100 of their SSB at the $50,000 basis level while the domestic couple’s benefits are still tax free. Over the next $18,000 they are being taxed 85% instead of 50% which increases their penalty up to $17,400.

The penalty finally ends at $107,412 when the domestic couple reaches their full 85% taxable SSB level.

Not to throw salt on it, but the domestic couple does have half of a way around this. You take a large amount out of your IRA on the odd years and I’ll do the same on the even years. My SSB is tax free this year yours is tax free next year!

PS: I never though this thread would go this far when all I was asking for the proper accounting term for the deferred or delayed taxation of our Social Security Benefits!