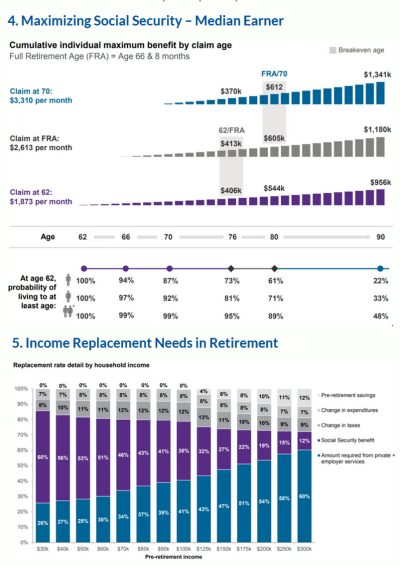

That 4th chart, the one with the breakeven points for taking SS at 62, 66yrs 8 mos, and 70 was a bit of an eye opener for me. I've run my own numbers through FireCalc, with the scenarios of taking SS at every year between 62-70, and found that it doesn't sway my chance of success very much. It seems like whether you live off investments early on, to get a bigger SS payment later, or take a smaller SS payment earlier, but not have to cash out as much of your investments, seems to come out in the wash.

But that chart opened up my eyes to how small the difference really was. Using the parameters of the chart, it looks like if you take SS at 70, instead of 62, you come out ahead by around 385,000. If you make it to 90. To me, it drives home the point that if you can afford to retire comfortably at a young age, don't stay in the work force longer just to get a bigger SS check.

Of course, I realize that not everyone can afford to do so. If you don't have a lot saved up for retirement, and/or still have a lot of debt, then it's a good idea to keep working a bit longer, for the bigger SS check, if you're able to. For me, waiting another 8 years to get an extra ~$1450 in the SS check isn't worthwhile, but for many, I'm sure it is. As the old saying goes, your mileage may vary.