dex

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Oct 28, 2003

- Messages

- 5,105

2008 is my 2nd full year of ER - Single, No debt (except for 906 in interest free furniture loan)

29,258 Total Spent

Unusual Items:

1,400 2 New computers - desktop and Asus eee

700 Truck tires

450 Dr. bills

906 Interest Free loan

25,802 Adjusted Spend

I'm estimating my 2009 budget at $30K

I think I need to step up my traveling and spend more.

So you young dreamers - it might not take as much to ER and you think. My estimate while working was $40K/yr growing at 4%/year plus 5K/yr in amortized items.

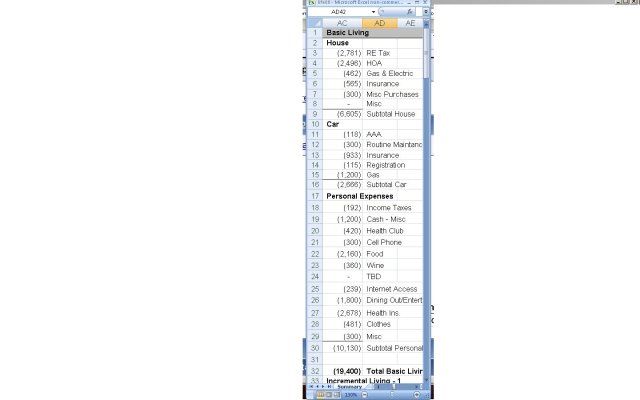

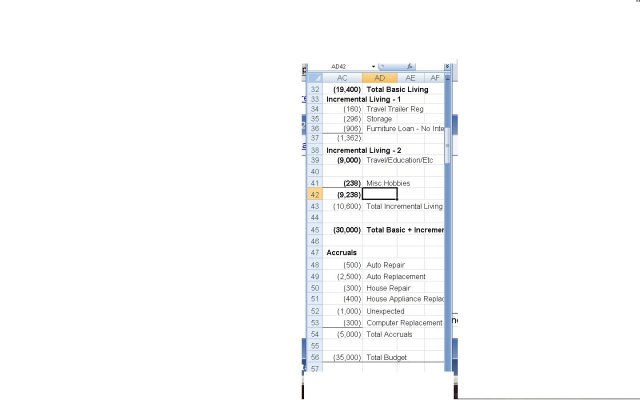

I break down my budget into:

Basic - estimate if I just stayed home the whole year

Incremental - travel and fun

In the Basic estimate there is about $600/month that could be added to the incremental budget for when I travel. So when I'm Rving, I have the incremental budget plus $600/month extra. If I were to travel for the whole year I would have the $9K in incremental plus $7.2K available in the Basic budget.

29,258 Total Spent

Unusual Items:

1,400 2 New computers - desktop and Asus eee

700 Truck tires

450 Dr. bills

906 Interest Free loan

25,802 Adjusted Spend

I'm estimating my 2009 budget at $30K

I think I need to step up my traveling and spend more.

So you young dreamers - it might not take as much to ER and you think. My estimate while working was $40K/yr growing at 4%/year plus 5K/yr in amortized items.

I break down my budget into:

Basic - estimate if I just stayed home the whole year

Incremental - travel and fun

In the Basic estimate there is about $600/month that could be added to the incremental budget for when I travel. So when I'm Rving, I have the incremental budget plus $600/month extra. If I were to travel for the whole year I would have the $9K in incremental plus $7.2K available in the Basic budget.