wingfooted

Recycles dryer sheets

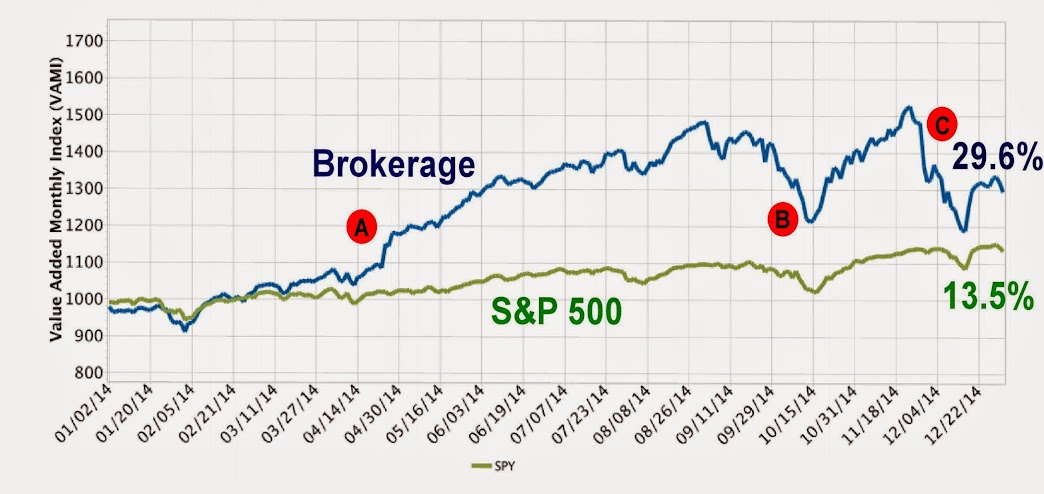

Post your 2014 investment returns here, inclusive of dividends and all fees. But exclusive of any contributions or withdrawals.

Commonly referred to as 'time weighted rate of return'.

Commonly referred to as 'time weighted rate of return'.

INVESTOPEDIA EXPLAINS 'TIME-WEIGHTED RATE OF RETURN'

It is assumed that all cash distributions are reinvested in the portfolio and the exact same periods are used for comparisons. When calculating time-weighted rate of return, the effect of varying cash inflows is eliminated by assuming a single investment at the beginning of a period and measuring the growth or loss of market value to the end of that period.

Last edited: