It seems these rates are same for any age group. That does not really make sense. Most young people will then just pay the penalty/tax instead. I thought there was a rule that the ratio between highest premiums and lowest premiums by age group cannot be greater than 3 to 1. This would mean that it is acceptable and even expected that there be different costs for each age group. I wonder why VT is doing it this way instead?

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

2014 preliminary individual health insurance rates announced in Vermont

- Thread starter pb4uski

- Start date

pb4uski

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

It seems these rates are same for any age group. That does not really make sense. Most young people will then just pay the penalty/tax instead. I thought there was a rule that the ratio between highest premiums and lowest premiums by age group cannot be greater than 3 to 1. This would mean that it is acceptable and even expected that there be different costs for each age group. I wonder why VT is doing it this way instead?

See post#4 of this thread. In short, VT is not age rated - from the BCBSVT filing it appears that the only differentiation is between kids and adults in developing head of household and family rates. The small group health insurance that I currently have is not age rated and appears that that concept is being expanded to individual insurance as well.

I'm not defending it, just explaining. I think it would be fairer to have some sort of grading so younger adults pay less.

It seems these rates are same for any age group. That does not really make sense. Most young people will then just pay the penalty/tax instead. I thought there was a rule that the ratio between highest premiums and lowest premiums by age group cannot be greater than 3 to 1. This would mean that it is acceptable and even expected that there be different costs for each age group. I wonder why VT is doing it this way instead?

after i read this post i went back and priced the insurance i bought from the mass health connector as if i was 42 instead of 62.

the price per month was 220 dollars less per month.

FIRE'd@51

Thinks s/he gets paid by the post

- Joined

- Aug 28, 2006

- Messages

- 2,433

Other than the premiums, does anyone know what the specific deductibles, copays, and OPM are for the various VT plans? Also, does the deductible count as part of the OPM? In many existing individual market plans it doesn't? Another important question is how RX costs work. Is there a separate deductible, copay, and OPM? Just knowing the various plans will pay 60-90% of the actuarial value isn't really all that helpful.

pb4uski

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Other than the premiums, does anyone know what the specific deductibles, copays, and OPM are for the various VT plans? Also, does the deductible count as part of the OPM? In many existing individual market plans it doesn't? Another important question is how RX costs work. Is there a separate deductible, copay, and OPM? Just knowing the various plans will pay 60-90% of the actuarial value isn't really all that helpful.

I think you'll find a lot of that stuff in pages 39-40 of the BCBSVT filing, but my understanding is that your first costs would go to the deductibles, then once the deductible is satisfied there would be copays and once the combination of the deductible and copays reach the OOPM it would be 100% on the insurer. Rx seems to be a separate deductible but no copay. I'm not familiar with some of the terms used but at this point will just wait for the marketing materials describing the plans.

Other than the premiums, does anyone know what the specific deductibles, copays, and OPM are for the various VT plans? Also, does the deductible count as part of the OPM? In many existing individual market plans it doesn't? Another important question is how RX costs work. Is there a separate deductible, copay, and OPM? Just knowing the various plans will pay 60-90% of the actuarial value isn't really all that helpful.

don't want to burst your bubble-but-based on mass the deductble will be 2000

to 2500 and the out of pocket 4000-5000 max

mass also has plans that use all sort of combinations-easier to go to mass connector than me to explain them

Midpack

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

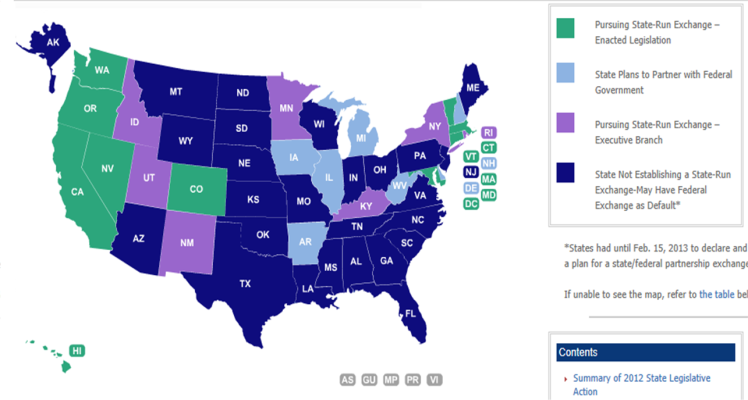

Will be interesting for those of us (like me) in states that have elected to 'default to federal exchanges.' Guess we find out Oct 1 or before...

State Actions to Implement the Health Benefit Exchange

Health Insurance Exchanges - Kaiser State Health Facts

State Actions to Implement the Health Benefit Exchange

Health Insurance Exchanges - Kaiser State Health Facts

Attachments

Last edited:

pb4uski

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

don't want to burst your bubble-but-based on mass the deductble will be 2000

to 2500 and the out of pocket 4000-5000 max

mass also has plans that use all sort of combinations-easier to go to mass connector than me to explain them

My friend, you seem to me to be stuck in a Obamacare = Romneycare rut. While Obamacare was loosely modeled on Romneycare, it is different and will not be the same so your all too frequent comparisons to Romneycare are not really helpful to the discussion.

Last edited:

My friend, you seem to me to be stuck in a Obamacare = Romneycare rut. While Obamacare was loosely modeled on Romneycare, it is different and will not the the same so your all too frequent comparisons to Romneycare are not really helpful to the discussion.

thats a valid point-however since Romneycare is currently the only thing around to compare it too thats what i use.

there is one thing however. if you go to my original thread all insurances not subsidized in aca-the last post or so has my links to mass AND california subsidized plan sheet. on each there are copays on 200-400 but no deductibles

this is california also.

this is why i believe there will be separate subsidized plans and non subsidized and that the subsidized plans will be linked to medicaid networks.

the other thing to remember is that not all states will be the same. states have the ability to make variations as long as they meet Obamacares core requirements.

i think the states that will run closer to the federal governments formula will be those that are letting the federal government create the exchange.

those that create their own will be different

Last edited:

pb4uski

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

fisherman

Full time employment: Posting here.

- Joined

- Jul 7, 2007

- Messages

- 500

lipitor and flomax are already generic have been for at least two years.

Viagra has been generic for years also just not in the US.

Viagra has been generic for years also just not in the US.

patent in usa runs out in a couple years

now ,now. you want it not to be like i'm saying so it benefits you. i'm conceding the point that Romneycare is not obamacare.

well just have to see

http://www.coveredca.com/media/10745/CoveredCA_HealthPlanBenefitsSummary.pdfnow ,now. you want it not to be like i'm saying so it benefits you. i'm conceding the point that Romneycare is not obamacare.

well just have to see

go to this page from california. the 2 lowest subsidized plans on left have no deductible. the next 2 on right have 1500 and 2000 deductibles respectivly

if you will look at bottom of first page the max out of pocket is 6400 mass has somewhat higher deductbles but lower out of pockets

Last edited:

Midpack

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

That's profound...i think the states that will run closer to the federal governments formula will be those that are letting the federal government create the exchange.

those that create their own will be different

That's profound...

i try to be-lol

i give sarcasm and i take sarcasm. you can't be as opinonated as i am and not have a thick skin

wmc1000

Thinks s/he gets paid by the post

The California plan shows $276 per month for a couple after subsidy - wow I'll risk the major illness as 1 year would save almost $10,000

The California plan shows $276 per month for a couple after subsidy - wow I'll risk the major illness as 1 year would save almost $10,000

i don't understand what you mean

wmc1000

Thinks s/he gets paid by the post

i don't understand what you mean

Without the subsidy my wife and I would pay approx $1,000 per mo. As it stands now as long as our MAGI stays under $60,000 our monthly subsidized premium would be $276. Saving $724 per mo. times 12 months equals $8,688 per yr. So, in 18 months we would save enough that even if we had a major health issue and had to cover the $12,500 max OOP we would still be even.

pb4uski

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

The Vermont Green Mountain Care Board modified and approved the proposed 2014 health insurance rates in the OP of this thread. They required a number of technical changes that ended up reducing rates by 4-5%.

Also see GREEN MOUNTAIN CARE BOARD: INSURERS MUST TRIM COSTS OF INSURANCE TO BE OFFERED THROUGH VERMONT HEALTH CONNECT

So subject to appeal to the Vermont State Supreme Court by the carriers (which I think is doubtful) we know at least one state's exchange rates for 2014.

Also see GREEN MOUNTAIN CARE BOARD: INSURERS MUST TRIM COSTS OF INSURANCE TO BE OFFERED THROUGH VERMONT HEALTH CONNECT

So subject to appeal to the Vermont State Supreme Court by the carriers (which I think is doubtful) we know at least one state's exchange rates for 2014.

Mulligan

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- May 3, 2009

- Messages

- 9,343

The Vermont Green Mountain Care Board modified and approved the proposed 2014 health insurance rates in the OP of this thread. They required a number of technical changes that ended up reducing rates by 4-5%.

Also see GREEN MOUNTAIN CARE BOARD: INSURERS MUST TRIM COSTS OF INSURANCE TO BE OFFERED THROUGH VERMONT HEALTH CONNECT

So subject to appeal to the Vermont State Supreme Court by the carriers (which I think is doubtful) we know at least one state's exchange rates for 2014.

Ouch! I would be hit with a 421% increase for the comparable HD plan I have now. And that is including my current premium just being jacked up 15% this month.

pb4uski

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

I found a nice display of the approved plans and rates.

http://healthconnect.vermont.gov/si...Designs with Final Rates_updated 7 31 v 4.pdf

http://healthconnect.vermont.gov/si...Designs with Final Rates_updated 7 31 v 4.pdf

Similar threads

- Replies

- 0

- Views

- 170

- Replies

- 43

- Views

- 2K

- Replies

- 8

- Views

- 852