robnplunder

Thinks s/he gets paid by the post

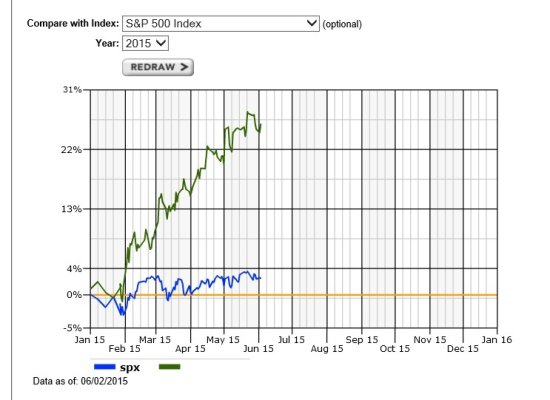

My trading account is up 28% so far this year. Don't get too excited, because it was up 70% last year in August and I finished dead even with the S&P500. I have even more time to waste my gains this year. At least I won't lose the gains the same way this year (oil drop got me last year)

Mines are up 19% and 11% (two trading accounts). Overall YTD is up 5%. Leaders are international funds. Laggards are Gold fund. Moved some bond fund into international ones.