NW-Bound

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Jul 3, 2008

- Messages

- 35,712

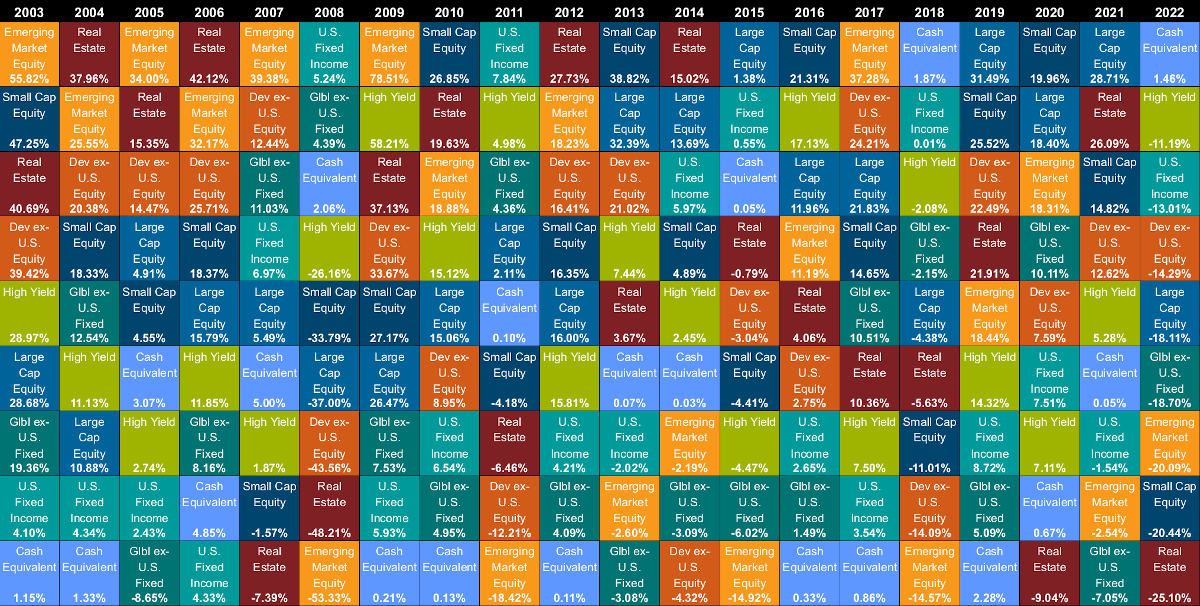

Based on 2016 full year time weighted average, inclusive of dividends, margin interest and all brokerage fees and excluding the impact of any additions or withdrawals from principal, I was up 10.4% versus 11.9% for the benchmark SP 500.

So I failed to 'beat the market' this year.

Big reason was a very weak start to the 2016 where at one point I was down 18%. I spent the rest of the year trying to catch up but didn't quite make it.

Biggest loser was trying to play mini arbitrage on the failed HAL - BHI merger.

Biggest winners were the energy names - APC, PXD and CXO - which rallied strongly in the second half.

2017 is another year - starting out well, lets see how it goes.

Early in 2016, you lost about 2.5x the drop of the S&P. That was surely stressful.

.