I filed for my mum on 2/23 and the refund appeared today in her bank account.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

2020 Fed Tax Refund Received!

- Thread starter RunningBum

- Start date

- Joined

- Oct 13, 2010

- Messages

- 10,735

- Joined

- Nov 27, 2014

- Messages

- 9,203

Got my refund in three days. I filed and my return was approved on Tuesday (3/9) and the refund is showing as a pending transaction in my account on Friday (3/12).

I rolled forward most of my return, but I thought it best to get some refund so that the Government would have my routing/account number in case they want to give me any more stimulus money in the future.

ETA: The refund cleared today (3/17). That's the kind of green I like on St Paddy's day.

I rolled forward most of my return, but I thought it best to get some refund so that the Government would have my routing/account number in case they want to give me any more stimulus money in the future.

ETA: The refund cleared today (3/17). That's the kind of green I like on St Paddy's day.

Last edited:

LXEX55

Recycles dryer sheets

2020 Tax Refund Yet?

Has anyone gotten their 2020 tax refund yet? If so, how long did you wait? Mine was electronically accepted nearly a month ago. The check your status app just says "being processed". The past three years, I have gotten my refund in less than two weeks.

Has anyone gotten their 2020 tax refund yet? If so, how long did you wait? Mine was electronically accepted nearly a month ago. The check your status app just says "being processed". The past three years, I have gotten my refund in less than two weeks.

The Cosmic Avenger

Thinks s/he gets paid by the post

Yep, our return was received by the IRS on 3/5, and our direct deposit arrived 3/12...and even showed up as pending on 3/11. But our stimulus payment hasn't; we are eligible for a partial payment based on our 2020 AGI, so they should have had that in the system on 3/5, but we would NOT be eligible based on our 2019 AGI. So we'll see if it shows up next week. But at least we got a nice big refund based on 1) lower income than usual, and 2) the remainder of the stimulus payments that we missed because they had been based on our 2019 AGI.

Last edited:

Has anyone gotten their 2020 tax refund yet? If so, how long did you wait? Mine was electronically accepted nearly a month ago. The check your status app just says "being processed". The past three years, I have gotten my refund in less than two weeks.

I filed 2/15 and it was accepted same day. I’m still waiting for refund. Check my status app just keeps saying being processed. My theory is that I’m getting ACA money back and that is holding things up since Nevada runs their own exchange? Not really interested in calling IRS to see what they say.

gayl

Thinks s/he gets paid by the post

My DD efiled 2/27. Her refund didn't show up until yesterday. My simple one took 4 days, her more complicated one took 2 weeks.

Surewhitey

Thinks s/he gets paid by the post

Waiting to file on Wednesday. Supposed to get the stimulus check then. I think we would be OK, just don't want to jinx it. We had an exceptional 2020...

Dawg52

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Filed my Federal and State via Turbo Tax(online version) and the Federal has already been accepted. Just 30 minutes after submitting it. Hope State goes through w/o a hitch. My refunds are minor so applied to estimated tax payments for 2021.

First time I've filed electronically in 3 or 4 years. Got away from it due to ID theft concerns but with everything else already out there.... why worry about this one.

First time I've filed electronically in 3 or 4 years. Got away from it due to ID theft concerns but with everything else already out there.... why worry about this one.

Dawg52

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Getting a tax refund is ..well...wonderful. Is there a need to let strangers know? Is ER that boring? What's next?... Announcing you have a bowel movement? lol

You bored enough to open a thread on refunds?

RunningBum

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Jun 18, 2007

- Messages

- 13,236

I started this thread to give an idea for others how quickly they might receive theirs. I thought it might be useful. If you pull down "Thread tools" you'll find "Ignore this thread" so you'll never be bothered when this pops up again.Getting a tax refund is ..well...wonderful. Is there a need to let strangers know? Is ER that boring? What's next?... Announcing you have a bowel movement? lol

jollystomper

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Apr 16, 2012

- Messages

- 6,184

Last year I e-filed on 3/7 and received our refund on 3/16. This year I e-filed on the same date. It will be interesting to compare the turnaround time.

Update: IRS site now shows status as approved and refund scheduled for 3/24. Eight days later as compared to last year. Not as bad as I thought it would be.

freedomatlast

Thinks s/he gets paid by the post

- Joined

- Oct 27, 2013

- Messages

- 1,189

I guess I'm going to have to start e-filing like most on here seem to do.

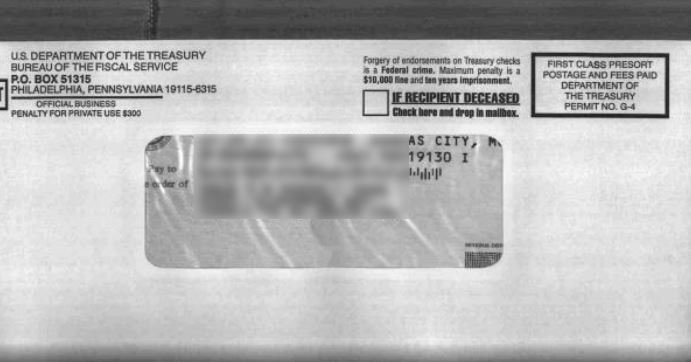

I sent my 22 page federal return in on March 1st, stopping by the post office first to make sure the two stamps I put on the envelope were of adequate postage. Post office clerk says it will cost 95 cents to send so my two stamps already affixed are good. Fast forward to Friday of last week and there in my mailbox is the envelope, returned to sender asking for another fifty cents postage due.

Another trip to the post office and the clerk says, no, the 95 cents was adequate and the correct amount due and blames their blunder in sending it back on short staffing and inadequate training. I did repackage it in another envelope this time since the other one was beat up from the round trip.

The PO clerk was very apologetic and slipped my envelope into a USPS envelope with that post office as the return address, and stamped the package as paid in full with no additional cost from me.

He said if it came back again, he would report it to the postmaster general.

So I already lost three weeks.

I sure hope getting my refund goes a lot smoother once it finally reaches the IRS.

I sent my 22 page federal return in on March 1st, stopping by the post office first to make sure the two stamps I put on the envelope were of adequate postage. Post office clerk says it will cost 95 cents to send so my two stamps already affixed are good. Fast forward to Friday of last week and there in my mailbox is the envelope, returned to sender asking for another fifty cents postage due.

Another trip to the post office and the clerk says, no, the 95 cents was adequate and the correct amount due and blames their blunder in sending it back on short staffing and inadequate training. I did repackage it in another envelope this time since the other one was beat up from the round trip.

The PO clerk was very apologetic and slipped my envelope into a USPS envelope with that post office as the return address, and stamped the package as paid in full with no additional cost from me.

He said if it came back again, he would report it to the postmaster general.

So I already lost three weeks.

I sure hope getting my refund goes a lot smoother once it finally reaches the IRS.

gayl

Thinks s/he gets paid by the post

Why do you paper file??I guess I'm going to have to start e-filing like most on here seem to do.

I sent my 22 page federal return in on March 1st, stopping by the post office first to make sure the two stamps I put on the envelope were of adequate postage. Post office clerk says it will cost 95 cents to send so my two stamps already affixed are good. Fast forward to Friday of last week and there in my mailbox is the envelope, returned to sender asking for another fifty cents postage due.

Another trip to the post office and the clerk says, no, the 95 cents was adequate and the correct amount due and blames their blunder in sending it back on short staffing and inadequate training. I did repackage it in another envelope this time since the other one was beat up from the round trip.

The PO clerk was very apologetic and slipped my envelope into a USPS envelope with that post office as the return address, and stamped the package as paid in full with no additional cost from me.

He said if it came back again, he would report it to the postmaster general.

So I already lost three weeks.

I sure hope getting my refund goes a lot smoother once it finally reaches the IRS.

freedomatlast

Thinks s/he gets paid by the post

- Joined

- Oct 27, 2013

- Messages

- 1,189

Why do you paper file??

My current laptop has Windows 7 and as far as I could tell, all tax programs this year required Windows 10 to work as intended.

Also, I like to really understand how everything works and inter-relates in the tax forms and what effects various changes will make from schedule to schedule and form to form. Doing the return by hand really brings this to light quickly.

gayl

Thinks s/he gets paid by the post

Oh. I must be really lazy. I just do it with the app on my smart phone. I can shift any number and see the corresponding reaction in total taxes

The Cosmic Avenger

Thinks s/he gets paid by the post

I did it for a few years because I was mad that the tax prep companies are charging me for something that makes processing my return MUCH easier for the government, but it didn't take long for me to realize that the only one I was making things harder for was myself! I still am het up that they don't PAY US to e-file, or at least offer it for free. Processing paper forms is very labor intensive.Why do you paper file??

- Joined

- Apr 14, 2006

- Messages

- 23,058

I still paper file. I know exactly what is on the paper when I sign my name to it. I have no clue what is in the computer file that gets e-filed with the IRS. I am not inclined to give them more than the bare minimum of information that the law requires.

Golden sunsets

Thinks s/he gets paid by the post

- Joined

- Jun 3, 2013

- Messages

- 2,524

Good to know Jolly. Our return was filed and accepted on 3/12. If I replicate your 2020 return experience I would expect a deposit on or about 3/29, although day of the week could tweak the day a bit.Update: IRS site now shows status as approved and refund scheduled for 3/24. Eight days later as compared to last year. Not as bad as I thought it would be.

My current laptop has Windows 7 and as far as I could tell, all tax programs this year required Windows 10 to work as intended.

Also, I like to really understand how everything works and inter-relates in the tax forms and what effects various changes will make from schedule to schedule and form to form. Doing the return by hand really brings this to light quickly.

I use to do my taxes by hand on paper until I was up against the dreaded Form 1116, Foreign Tax Credit and the AMT worksheet(s).

The Cosmic Avenger

Thinks s/he gets paid by the post

Well, our stimulus payment showed up today! Now I kind of wish I had waited on our taxes, though, since our AGI was $153K and change, and that reduced our stimulus payment by $3K! I would have spent some more time trying to generate another $3K in deductions before 4/15 if I had known that the cutoff was going to be $150K....but then again, I'm not sure it would be worth the trouble, we really didn't NEED the stimulus. We'll definitely spend it supporting our local restaurants, though!Yep, our return was received by the IRS on 3/5, and our direct deposit arrived 3/12...and even showed up as pending on 3/11. But our stimulus payment hasn't; we are eligible for a partial payment based on our 2020 AGI, so they should have had that in the system on 3/5, but we would NOT be eligible based on our 2019 AGI. So we'll see if it shows up next week. But at least we got a nice big refund based on 1) lower income than usual, and 2) the remainder of the stimulus payments that we missed because they had been based on our 2019 AGI.

Golden sunsets

Thinks s/he gets paid by the post

- Joined

- Jun 3, 2013

- Messages

- 2,524

Well, our stimulus payment showed up today! Now I kind of wish I had waited on our taxes, though, since our AGI was $153K and change, and that reduced our stimulus payment by $3K! I would have spent some more time trying to generate another $3K in deductions before 4/15 if I had known that the cutoff was going to be $150K....but then again, I'm not sure it would be worth the trouble, we really didn't NEED the stimulus. We'll definitely spend it supporting our local restaurants, though!

Well if it is like the 2020 return reconciliation, I think you can claim a partial amount withheld at the time that you file your 2021 return.