target2019

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Yeah, it's for fun and starting conversations. I have a sheet going back to 1990 where I recorded monthly account totals and in some cases individual funds. When I look at the area graph for 30 years, that is sufficient for me. But I can see why monhly performance details are important too.I completely agree. It was just the comment I keep seeing "after subtracting expenses" that got me wondering. I certainly didn't think homes, cars, precious metals, art, ect would be included. And I guess I would have to agree that NW would include these.

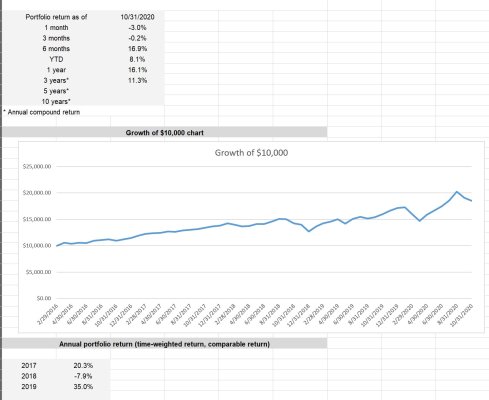

People have different methods for calculating performance, and I that keeps this game interesting. There have been posts from time to time where methods are laid out.