NW-Bound

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Jul 3, 2008

- Messages

- 35,712

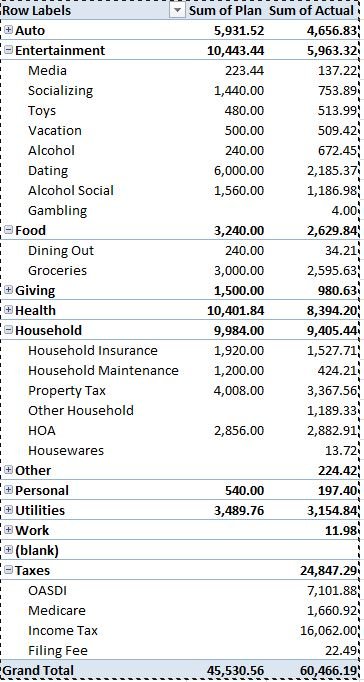

You're right that to "do it accurately" it would be too much work. For me, it's a conceptual thing. One of the things that's also too much work is to split mortgage payments (I have none now, but before). The interest portion is gone-gone, but the principle was just a transfer from an asset account to a liability account. On the "cash flow" it made a difference, but on the spending, the principle portion "didn't count". It's just a hobby, because there's no need to put such a fine point on it. My short stint as a financial analyst doomed me to think of these kinds of things

Here, I will agree with you that it makes sense to split a mortgage payment so that you do not count the principal portion as an expense. What one would do is to list the home mortgage as a liability, and show that the mortgage payment offsetting that liability. It is a significant amount of money, and is not the same as splitting a Costco receipt to keep track of alcohol consumption vs. food, for example. Maybe the latter would make sense for someone who drinks a lot more than me.

There should be a way to do the above with Quicken, and is worthwhile for people with a large mortgage payment. They probably also want to show the equity in their home as an asset.

As for me, I never think much about the value of my homes, and totally concentrate on growing my investable assets, which are a lot more liquid and larger. I also cannot trade, er, rebalance the value of my homes, so I don't pay much attention to them. But when I have to pay for maintenance, it comes out of my pockets, and I don't like it.

Last edited: