Same here, have been getting it free for many years. Now only the $20 offer. I guess being all self directed Fidelity is sending me a message.

Another kind of funny, on my home page it no longer lists my advisor. Advisor is still there at my local office, and is still assigned to me, but now it does not have his name and contact info. Just the generic PCG. Another Fidelity sending me a message?

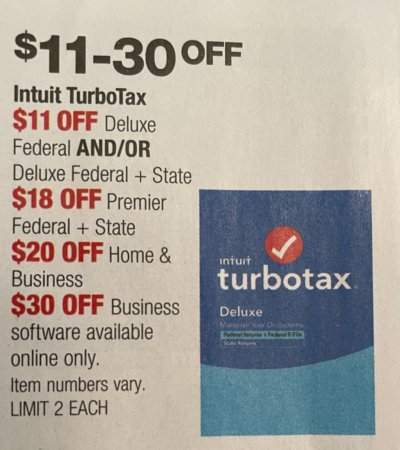

I might just switch to TaxAct over TurboTax this year if i have to buy it out of pocket. TT prices are increasing each year, just been immune from the cost since fidelity offered it free.