2022 TurboTax and H&R Block tax programs are out.

Only deal I've seen is a coupon for $15 off from an H&R Block email.

I usually get a much better deal. I have set up camelcamelcamel to notify me when H&R Block drops below $25 at Amazon.

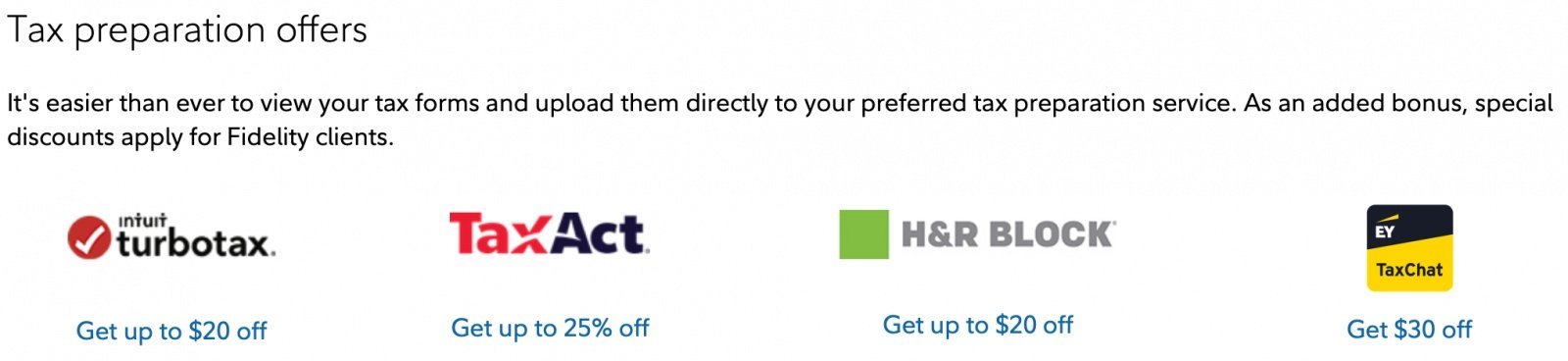

Please post any deals you see on any tax software.

Only deal I've seen is a coupon for $15 off from an H&R Block email.

I usually get a much better deal. I have set up camelcamelcamel to notify me when H&R Block drops below $25 at Amazon.

Please post any deals you see on any tax software.

Last edited: