ERD50

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

I've never found anything clear on this. The $250K/$500K (single/married) exemption on cap gains on a primary residence took effect in 1997. But what about any previous home sales? At the time, the cap gains were rolled into the next home, and nothing due until a final sale. Do they get chained together to the post-1997 sale, or ignored? (skip to the last bold for the concise version w/o example).

For simplicity, assume the cost basis is just the purchase price. What happens with this example string of buys/sells?

Buy_ Home #1: $25K in 1975

Sell Home #1: $50K in 1985 ( $25K cap gains was deferred, rolled into Home #2)

Buy_ Home #2: $ 50K in 1985

Sell Home #2: $100K in 1995 ( $50K + $25K cap gains was deferred, rolled into Home #3)

Buy_ Home #3: $100K in 1995

Sell Home #3 : $600K in 2020

The sale of Home #3 has cap gains of $500K, so would be exempt. But what about the previous sales? They generated $75K of cap gains. Are those rolled into the cost basis of Home #3, or ignored? If rolled up, the cap gains are $575K, and taxes are due.

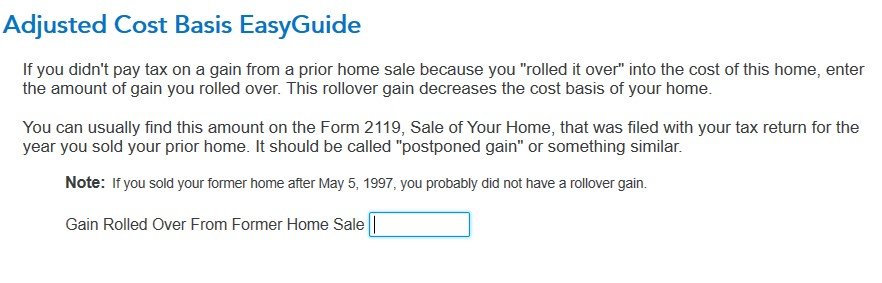

Does the IRS expect you to have cost basis records back to 1975 (they do for stock buys for example, so I guess so)? I dug up my 2119 forms (Sale/Exchange of Your Home/Principal Residence) for the actual years I bought/sold the homes, and I see that the cost basis of my current (#3) home was reduced by the deferred gains, so that would increase the gain on the sale. But when I look at the current rules in pub 523, it just asks for purchase price, no mention af the form 2119 adjusted basis. Is it just 'forgiven'? https://www.irs.gov/pub/irs-pdf/p523.pdf The "good" news is, with either the straight purchase price or the adjusted price, we won't be exceeding the $500K gain anyhow, even w/o accounting for capital improvements (be nice to throw out all those old receipts!). But I'd still like to understand this.

Now that I was forced to go through this thought process to write this, I guess it all comes down to:

Does my cost basis for home #3 start with the actual purchase price, or is it the lower number (higher gain) from my old 2119?

TIA - ERD50

For simplicity, assume the cost basis is just the purchase price. What happens with this example string of buys/sells?

Buy_ Home #1: $25K in 1975

Sell Home #1: $50K in 1985 ( $25K cap gains was deferred, rolled into Home #2)

Buy_ Home #2: $ 50K in 1985

Sell Home #2: $100K in 1995 ( $50K + $25K cap gains was deferred, rolled into Home #3)

Buy_ Home #3: $100K in 1995

Sell Home #3 : $600K in 2020

The sale of Home #3 has cap gains of $500K, so would be exempt. But what about the previous sales? They generated $75K of cap gains. Are those rolled into the cost basis of Home #3, or ignored? If rolled up, the cap gains are $575K, and taxes are due.

Does the IRS expect you to have cost basis records back to 1975 (they do for stock buys for example, so I guess so)? I dug up my 2119 forms (Sale/Exchange of Your Home/Principal Residence) for the actual years I bought/sold the homes, and I see that the cost basis of my current (#3) home was reduced by the deferred gains, so that would increase the gain on the sale. But when I look at the current rules in pub 523, it just asks for purchase price, no mention af the form 2119 adjusted basis. Is it just 'forgiven'? https://www.irs.gov/pub/irs-pdf/p523.pdf The "good" news is, with either the straight purchase price or the adjusted price, we won't be exceeding the $500K gain anyhow, even w/o accounting for capital improvements (be nice to throw out all those old receipts!). But I'd still like to understand this.

Now that I was forced to go through this thought process to write this, I guess it all comes down to:

Does my cost basis for home #3 start with the actual purchase price, or is it the lower number (higher gain) from my old 2119?

TIA - ERD50