almost there

Thinks s/he gets paid by the post

- Joined

- Sep 24, 2008

- Messages

- 1,017

What would you recommend if you wanted a low risk 4 1/2% return in your IRA? Starting today.......

Bonds seem shaky as interest rates will climb over the next several yrs.

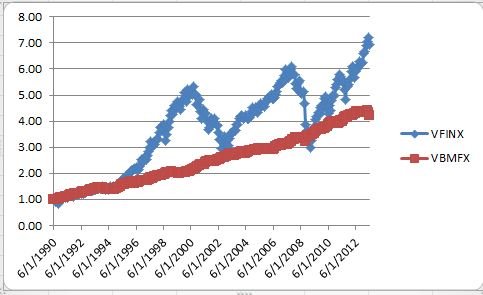

And looking at the 25 yr S&P 500 chart does not instill confidence.

S&P 500 Index Chart - Yahoo! Finance;

Just thought it would be interesting to see what folks think.

Bonds seem shaky as interest rates will climb over the next several yrs.

And looking at the 25 yr S&P 500 chart does not instill confidence.

S&P 500 Index Chart - Yahoo! Finance;

Just thought it would be interesting to see what folks think.