Sorry if this comes off a bit "Ranty", but do other people with 401k's find their choices completely limiting/terrible?

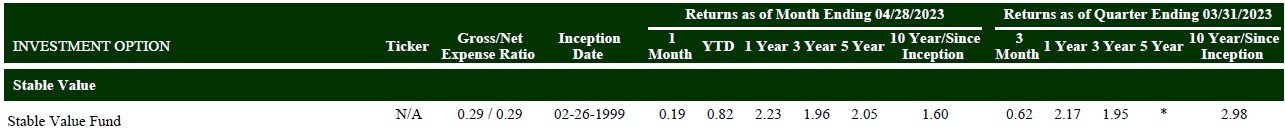

I was checking out the fixed capital preservation account offered by my S&P company, and it stinks! Barely 2% annualized. Seems like a huge disconnect considering what the short term (and even longer term now) fixed asset market looks like.

Anyone in a similar boat?

I was checking out the fixed capital preservation account offered by my S&P company, and it stinks! Barely 2% annualized. Seems like a huge disconnect considering what the short term (and even longer term now) fixed asset market looks like.

Anyone in a similar boat?

Last edited: