Digital Nomad

Dryer sheet wannabe

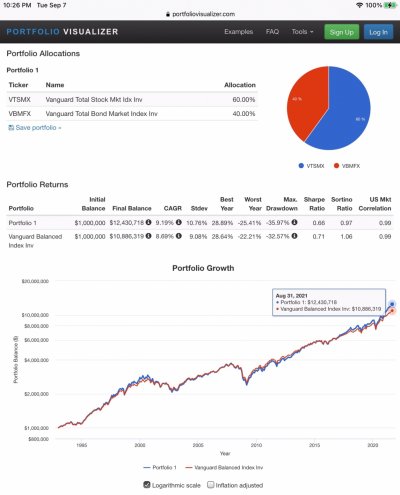

Retiring soon and most of the money in my IRA is a balanced mutual fund that is 60% stocks and 40% bonds. I wonder if I made a mistake and should have broken the investments into two funds. (Like 60% VTI and 40% FTBFX).

That way if the stock market crashes and I have to withdraw funds I can take money only out of my bond fund (FTBFX) until the market recovers. Vs if I only have money in a balanced mutual fund I will be forced to sell an investment that is 60% stocks locking in my losses.

Anyone here scared of owning only balanced funds during terrible bear markets?

(Or do you prefer a balanced fund because you don't have to worry about rebalancing your investments?)

That way if the stock market crashes and I have to withdraw funds I can take money only out of my bond fund (FTBFX) until the market recovers. Vs if I only have money in a balanced mutual fund I will be forced to sell an investment that is 60% stocks locking in my losses.

Anyone here scared of owning only balanced funds during terrible bear markets?

(Or do you prefer a balanced fund because you don't have to worry about rebalancing your investments?)