Enjoy the Ride

Dryer sheet wannabe

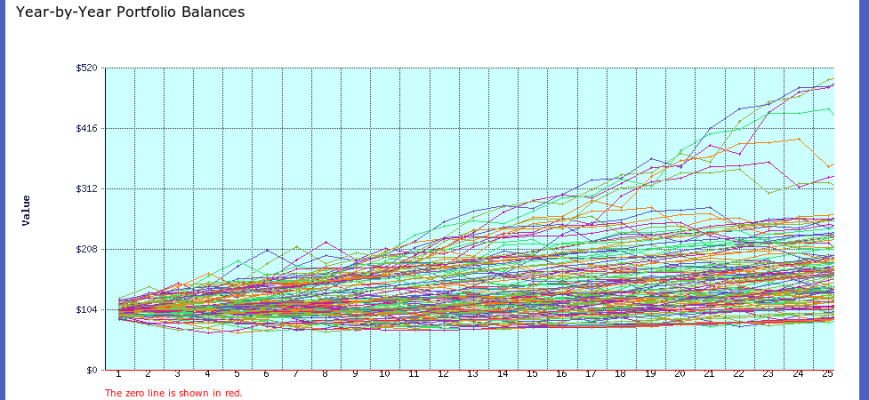

Our portfolio is 90% equity and 10% bond. This is for 401k and roth IRA so will be withdrawing in 26 years when we're 60. Back in 09, our porfolio dropped 40% and we were ok. Bought more into the market.

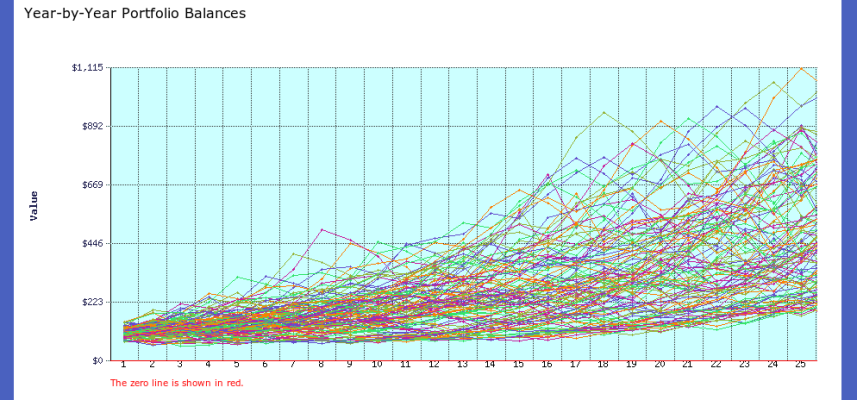

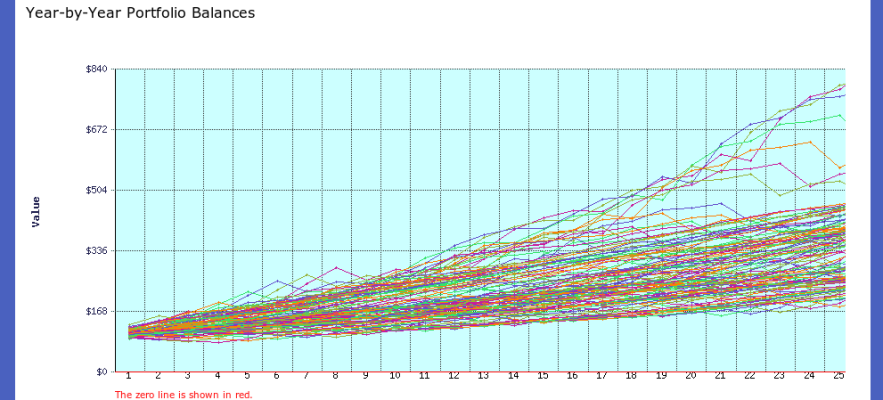

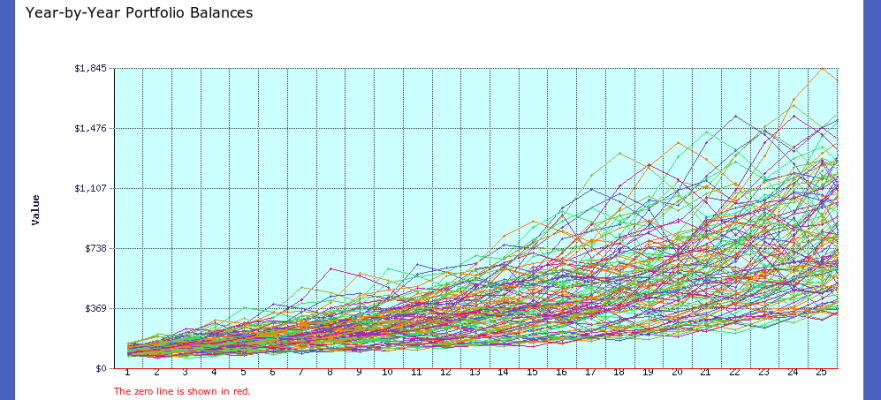

Assuming we will keep it in there until we're 60, does it make sense to increase bond allocation? It seems that the main reason for equity/bond is to decrease risk but, if we're ok with fluctuation in porfolio, doesn't it make sense to keep more in equity for higher overall return?

Based on the books I've read, 90%/10% seems too high so that's why I'm having this dilemma.

Thanks

Assuming we will keep it in there until we're 60, does it make sense to increase bond allocation? It seems that the main reason for equity/bond is to decrease risk but, if we're ok with fluctuation in porfolio, doesn't it make sense to keep more in equity for higher overall return?

Based on the books I've read, 90%/10% seems too high so that's why I'm having this dilemma.

Thanks