I was trying to put the current DJIA/market level into context, and thus played with a "thought experiment." I'd like y'all to check my math and logic:

"On Nov 15, 2016 the DJIA was at 18,858. On March 13, 2020 (40 months later) it was 23,185. What continuously compounded annual growth rate does this represent?"

In other words, if the DJIA had simply been growing at a steady-Eddy rate for the 40 months, rather that the huge run-up and then precipitous fall, what would that steady rate be?

For continuous compounding, using t=month and r=monthly growth rate, so 12*r = R, annual growth rate,

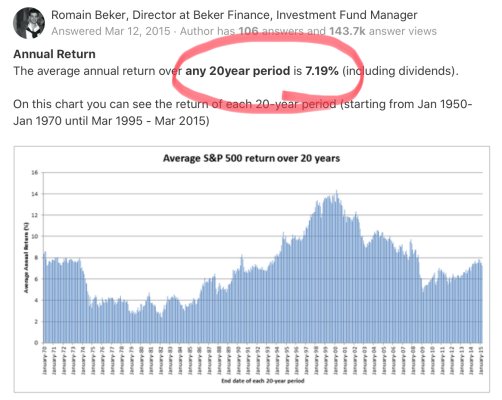

I calculated that growth from 18,858 to 23,185 over 40 months implies an annual continuous growth rate of R= 6.2%.

So, if I've got that right, then it seems to me that even at Friday's level after sharp drops, I should still be feeling pretty good.

Yes? No?

Alas, when I plug in Monday's close at 20,841 that corresponds to an annual growth rate of 3.0%.

"On Nov 15, 2016 the DJIA was at 18,858. On March 13, 2020 (40 months later) it was 23,185. What continuously compounded annual growth rate does this represent?"

In other words, if the DJIA had simply been growing at a steady-Eddy rate for the 40 months, rather that the huge run-up and then precipitous fall, what would that steady rate be?

For continuous compounding, using t=month and r=monthly growth rate, so 12*r = R, annual growth rate,

P(2) = P(1) exp (r*40) and R=12*r

So, if I've got that right, then it seems to me that even at Friday's level after sharp drops, I should still be feeling pretty good.

Yes? No?

Alas, when I plug in Monday's close at 20,841 that corresponds to an annual growth rate of 3.0%.

Last edited: