I've recently started looking into the possibility of my retirement, and have what feels like a naive question, but I'll ask anyway...

Firstly, it seems that choosing a withdrawal strategy largely depends on personal beliefs and individual circumstance, but if we assume for the sake of argument that there might be, say, four main strategies. Each designed to optimise your income and protect against things like sequence risk, inflation and market volatility.

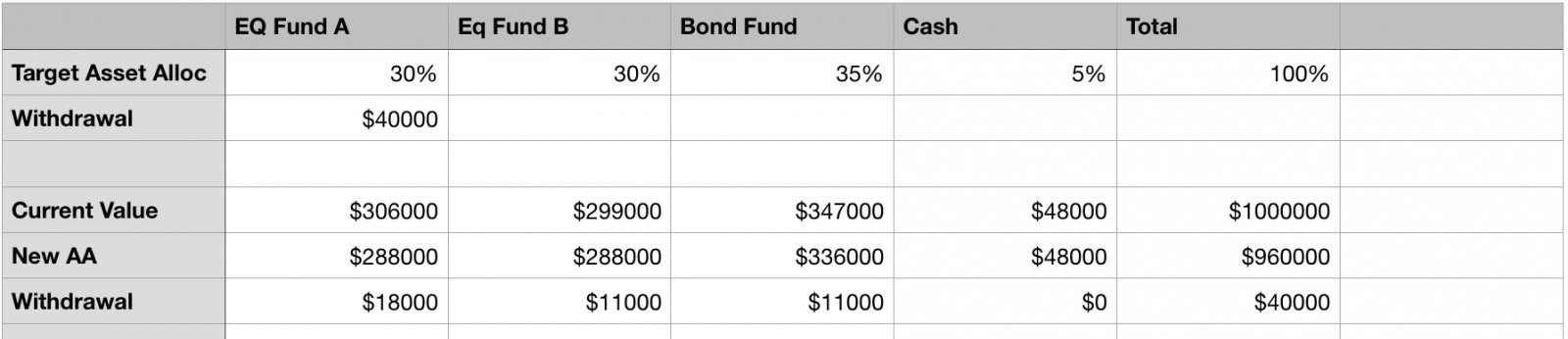

Secondly, assume (again for the sake of argument) that most people have a fairly mixed portfolio. Something like 60/40 stocks/bonds made up of maybe five to ten or more funds or individual holdings, and cash.

Would it be feasible to put together a tool (a website, I'm assuming a bit like FIRECalc) that allows you to enter (and remember) your portfolio details and then have it calculate the necessary actions you need to take each time you need to draw down, according to your chosen strategy?

I ask because while there is a lot of talk about the pros and cons of various strategies, there seems very little available on how to actually implement them. The calculations may be pretty easy of course, but if things like asset allocation, platform fees, tax and other implications of selling/buying in retirement are taken into account, it gets a bit complicated. Particularly as I might not trust myself to get it right every time - I might be having to do it when I'm 80 at some point, after all!

Forgive me if such tools exist - I've just not encountered them yet!

Firstly, it seems that choosing a withdrawal strategy largely depends on personal beliefs and individual circumstance, but if we assume for the sake of argument that there might be, say, four main strategies. Each designed to optimise your income and protect against things like sequence risk, inflation and market volatility.

Secondly, assume (again for the sake of argument) that most people have a fairly mixed portfolio. Something like 60/40 stocks/bonds made up of maybe five to ten or more funds or individual holdings, and cash.

Would it be feasible to put together a tool (a website, I'm assuming a bit like FIRECalc) that allows you to enter (and remember) your portfolio details and then have it calculate the necessary actions you need to take each time you need to draw down, according to your chosen strategy?

I ask because while there is a lot of talk about the pros and cons of various strategies, there seems very little available on how to actually implement them. The calculations may be pretty easy of course, but if things like asset allocation, platform fees, tax and other implications of selling/buying in retirement are taken into account, it gets a bit complicated. Particularly as I might not trust myself to get it right every time - I might be having to do it when I'm 80 at some point, after all!

Forgive me if such tools exist - I've just not encountered them yet!