- Joined

- Nov 27, 2014

- Messages

- 9,206

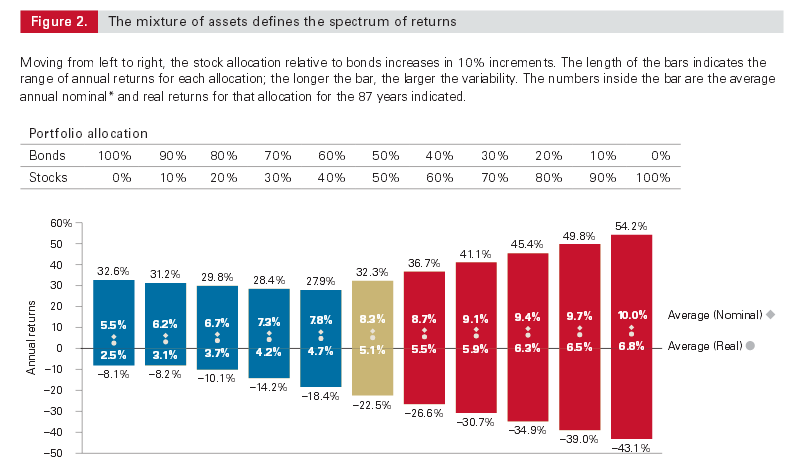

My AA is too conservative. In combining all our accounts, we're at 30% stock, 40% bonds and 30% cash. Note that I put a cash option pension plan and a small annuity in the bonds category so without that, our AA would be 41/19/40. Still, very conservative. I've just retired, but I have a year severance so financially I will be dependent on my portfolio a year from now so I'm working to get everything in order.

In general, DW and I would be pretty conservative anyway, but I think I need to get my AA up closer to 60/40. The question I have it an old one. How best to do this in the current environment? Certainly, it's hard to think about buying stock right now. Bonds seem to have no where to go but down and cash doesn't return much if anything more than inflation.

I could take my lump sum from the pension and just bit the bullet and put that into a stock fund. If I did that, I'd be at about 55/15/30 which doesn't seem too bad, just that it's so hard to buy in at these values. We're talking about $450,000 that I need to shift. Another option that I've read here is to do a dollar cost averaging - put a certain amount in over a certain time frame - Say $100K a year for 4.5 years.

What would you do - all in or phase in. Also, any reason to go any higher than the 15% on the bonds? At 30% cash, I would have 7 years living expenses in cash.

I appreciate the input from this group. I'm going to a meeting with Fidelity on Monday where this will be discussed and while not final decision will be made at that meeting, I'm looking to be as prepared as possible. I'm working two angles. First, DW is not that educated in finances so I need to make sure she understands and is comfortable with what I'm doing and second, I wouldn't be at a meeting with Fidelity if I didn't think they had a perspective to offer, but I'm not going to blindly follow their lead and want to challenge their assumptions/recommendations where appropriate.

In general, DW and I would be pretty conservative anyway, but I think I need to get my AA up closer to 60/40. The question I have it an old one. How best to do this in the current environment? Certainly, it's hard to think about buying stock right now. Bonds seem to have no where to go but down and cash doesn't return much if anything more than inflation.

I could take my lump sum from the pension and just bit the bullet and put that into a stock fund. If I did that, I'd be at about 55/15/30 which doesn't seem too bad, just that it's so hard to buy in at these values. We're talking about $450,000 that I need to shift. Another option that I've read here is to do a dollar cost averaging - put a certain amount in over a certain time frame - Say $100K a year for 4.5 years.

What would you do - all in or phase in. Also, any reason to go any higher than the 15% on the bonds? At 30% cash, I would have 7 years living expenses in cash.

I appreciate the input from this group. I'm going to a meeting with Fidelity on Monday where this will be discussed and while not final decision will be made at that meeting, I'm looking to be as prepared as possible. I'm working two angles. First, DW is not that educated in finances so I need to make sure she understands and is comfortable with what I'm doing and second, I wouldn't be at a meeting with Fidelity if I didn't think they had a perspective to offer, but I'm not going to blindly follow their lead and want to challenge their assumptions/recommendations where appropriate.