Red Badger

Thinks s/he gets paid by the post

Had a sit down with a local FIDO FA last week. After meet & greet, I explained that I am an index investor. A buy and hold until death kinda fellow, with only one stock fund (total US market) and 2 two bond funds (half total US Bonds fund and half in TIPS). Further explained that I'm not interested in complexity or managed funds; my simple plan got me far enough fast enough.

The reason for my visit was to discuss where to keep about two years of "Beer Money" (that I mentioned in a different posting/different subject here last week). Anyway, we cracked that nut with a money market (about 3 months of $$) with the balance in a CD ladder spread over the remaining 21 months.

So here's the "money shot...." He was surprised I had no international fund. I explained that most megac*rps have substantial juice internationally, and I was getting mine through those conglomerates buried in my funds. In example, the shop I w*rked at had about 40% of revenues from markets outside NA. And, our stock price reflected the waxing and waning of different global regions.

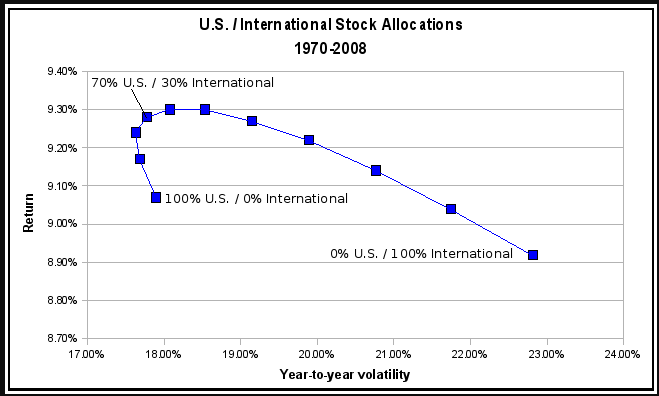

So, while I am not adamantly opposed to adding a little int'l exposure, I don't see any compelling argument to do so. So, to those around here that are far more knowledgeable about investing strategy, is his advice (10% Int'l) just tinkering with a portfolio, or is adding ~10% to Int'l some I need to re-look (but if I did, It would be FIDO's total int'l index fund)?

The reason for my visit was to discuss where to keep about two years of "Beer Money" (that I mentioned in a different posting/different subject here last week). Anyway, we cracked that nut with a money market (about 3 months of $$) with the balance in a CD ladder spread over the remaining 21 months.

So here's the "money shot...." He was surprised I had no international fund. I explained that most megac*rps have substantial juice internationally, and I was getting mine through those conglomerates buried in my funds. In example, the shop I w*rked at had about 40% of revenues from markets outside NA. And, our stock price reflected the waxing and waning of different global regions.

So, while I am not adamantly opposed to adding a little int'l exposure, I don't see any compelling argument to do so. So, to those around here that are far more knowledgeable about investing strategy, is his advice (10% Int'l) just tinkering with a portfolio, or is adding ~10% to Int'l some I need to re-look (but if I did, It would be FIDO's total int'l index fund)?