poorgeezer

Dryer sheet wannabe

- Joined

- Mar 7, 2011

- Messages

- 12

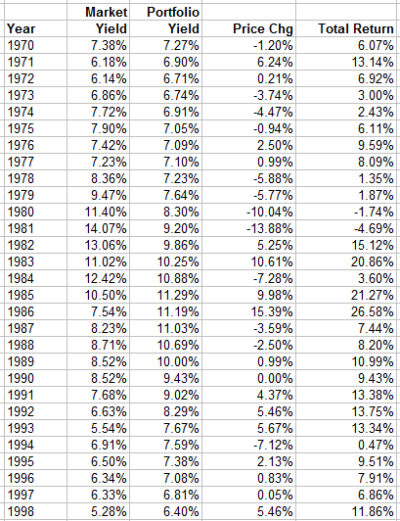

I retired in 2005 and am currently living on savings. I am 58 years old and will begin drawing on my retirement IRA with Vanguard at age 59 1/2. My concern is about my lack of understanding on how the Total Bond Index funds actually work. The concern being that if we get into a rising rate environment it seems that the bond fund would shrivel up similar to the way things went in the early 80's. Is this a valid concern or am I missing something and if that is the case what should I do? My AA is about 50/50 in index funds and I have enough cash on hand to coast approx. five years.

Thanks for your thoughts on this.

PG

Thanks for your thoughts on this.

PG