Approaching RE, I have just discovered that my tolerance for volatility has gone down significantly comparing to a few years ago. The test I created for myself was this: I stared at my account numbers, then imagine losing 1/2, 1/3, or 1/4 of that amount. 1/2 loss tolerance would translate to 100/0 stock/bond AA in my mind; 1/4 loss would translate to 50/50 in a "worst case" stock drop (imagine 50% drop). In other words, if I can take a 50% loss at any time, I can tolerate up to having a 100% stock AA.

When I retired I used similar strategies to determine my AA/risk tolerance and felt confident I could handle a substantial drop in equity prices without too much worry. Then along came the "market unpleasantness" of 08/09 and I got a real education. What I learned was this:

- You don't really know what your risk tolerance is until it isn't a drill, until it's the real thing.

- Your tolerance level isn't determined simply by the

amount of decline, the

speed of the decline can also play a major role.

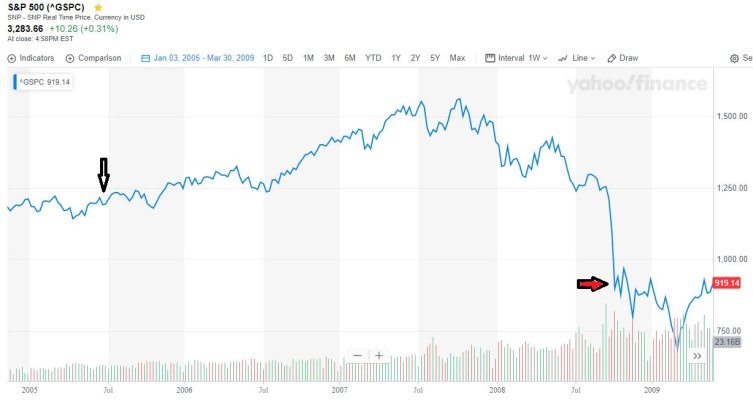

Case in point - see attached.

The first arrow shows the S&P 500 was around 1,200 when I retired in mid 2005. We had no pension or other source of income and were living entirely off our portfolio when the big hurt came along in late 2008. The red arrow indicates when the S&P 500 fell to 899 on 10/10/2008, a decline of 350 points over a period of three weeks (15 trading days with a loss almost every day). Prior to this drop the market had already declined 300 points from the 2007 high. But It wasn't just the fact the market had suddenly declined by another 350 points (28%), it was how quickly that decline happened - and the fact nothing appeared to stand in the way of that drop continuing.

That red arrow day was the day 1) I clearly understood I had severely misjudged my risk tolerance and 2) I completed my online application for SS (so much for waiting to 70!) to attempt to reduce the drain on my portfolio.

Fortunately I didn't make any rash portfolio changes, just held on until things started to turn around in the Spring of 2009. I did do some adjusting on my AA after the recovery got going, reducing my equity allocation by about 15 points, to a level I now

think I can weather without too much worry when the next big, sustained decline comes along.

But I won't know until it happens - and neither will most folks posting here.