Perfect timing, this article (AP, no paywall).

An interesting point in this is that You (OP, young investor who has never seen a Bull) are going to be a key actor in the next downturn. That is, how you and your peers react. Will you collectively panic, decide the music has stopped, and seal your losses by selling early? Or will you ride it out? It will be interesting to see.

https://apnews.com/4447e6969fb3478db5b8e0bb528ac0ec

I agree. Panic and fear really exaggerate the hurt and pain when bear chatter hits the news reel.

Technically, the first time I entered the market myself was around 2008 when I finally had the option to receive a 401k match at an IT firm. I had the option at some construction jobs before, but those guys never really had the acumen to give me much advice.

Wasn't until I got into IT that I realized investing was something everyone should probably be doing. I was in some target date retirement fund back then and it was way too conservative, I was actually in some bonds that first year I invested, which in hindsight probably wasn't a bad thing.

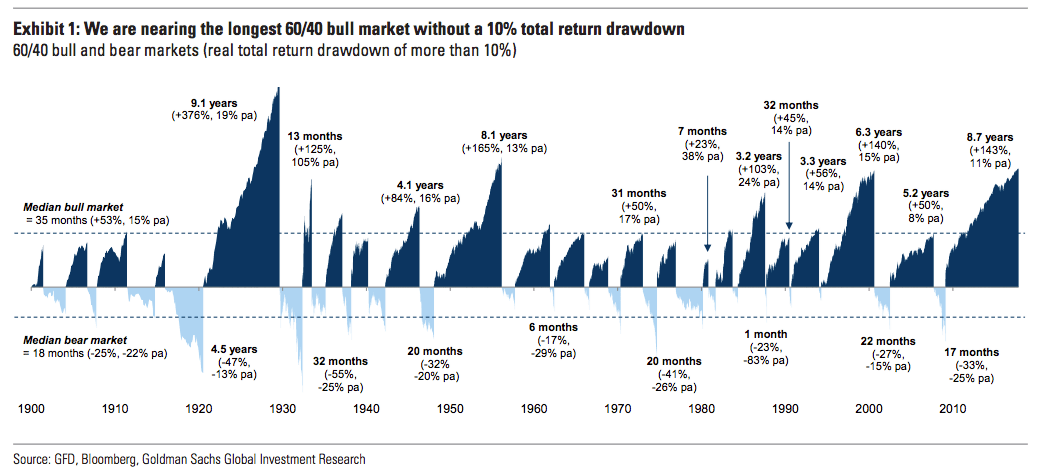

I feel I'm experienced enough to know how to "not react" to the fear and panic. And if I ever see a 10% sale, with a bear imminent, I will be prepared to do everything short of starve myself to buy that dip.

Even though I didn't feel the pain of some of you older investors, I know it is inevitable. Not something I look forward to but its also an opportunity (unless you literally just retired).

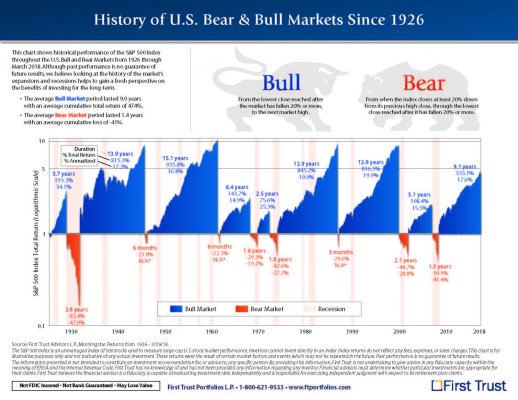

With a good 13 to 18 years before I ER, I can't really worry too much what happens. I guess technically I would want to see a bear no sooner than about 7-8 years from now so it will be recovered and in bull territory when I pull the plug in 2031. But after seeing folks retire in almost every imaginable scenario, I am not losing sleep.

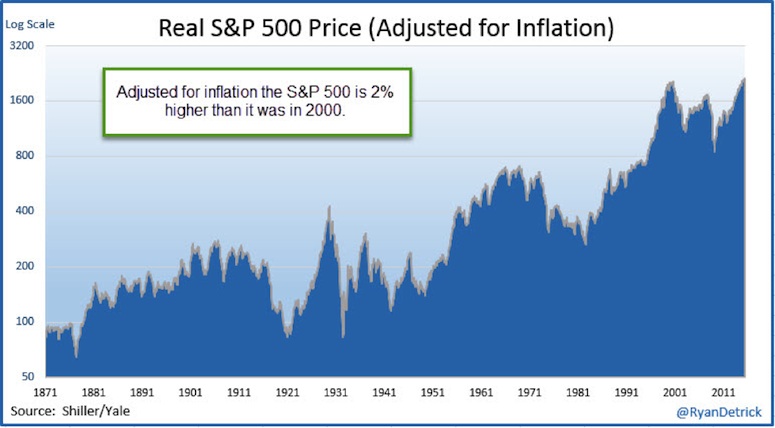

I obviously watched my dad jumping for joy in 2000 and basically getting shoved back into the seat when Pets.com went under lol. I still really don't know the lesson learned from the .COM bubble, it seems to me everything was just completely overvalued at the time.

The housing collapse, and those packaged derivatives of the 2005-2007 era were something else too, but those results made a bit more sense to me.

I guess I am glad I've learned my history lessons from others so far, but like I said...it's inevitable, I will see a bear run in my life.

I had originalyl booked a trip out to Wall St for October, thinking we would hit this milestone then. Had planned on snapping a pic of me riding that bull they have down there on Wall St. Looks like the milestone came a month or so sooner than my projection.

We decided to skip New York, with a 3 and 1 yr old people kept telling us we were crazy to try and visit the city.