rafapark

Dryer sheet wannabe

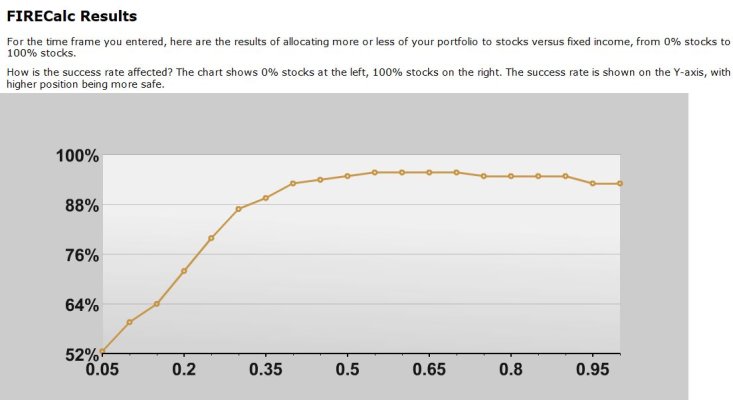

I plan to retire in 2016 and throughout the past years I've been moving my investments to match where I want to eventually be in terms of allocation. My approach is similar to most people: take the necessary risk to match my expected return but no more. This is where I have my question. Basically, I'd like to understand how others are calculating this. For example, say I want to withdraw 2% a year. So I am estimating that a 30% Stock, 70% fixed should get me the average return to meet that requirement and keep up with inflation with the lowest possible risk. How are others approaching this? I am trying to develop a table that would look like this ( just examples):

if Withdrawal

2%

Then Allocation

30% equities/70% fixed

if Withdrawal

3%

Then Allocation

40% equities/60% fixed

if Withdrawal

4%

Then Allocation

45% equities/65% fixed

and so on.

Or another way to put this is, instead of withdrawal %, I could include expected return. I am just guessing the allocations above. I wonder is there is a better way to do this. Maybe a formula that will give me the recommended allocation to the expected withdrawal or expected average return throughout the years.

Thanks for the input

if Withdrawal

2%

Then Allocation

30% equities/70% fixed

if Withdrawal

3%

Then Allocation

40% equities/60% fixed

if Withdrawal

4%

Then Allocation

45% equities/65% fixed

and so on.

Or another way to put this is, instead of withdrawal %, I could include expected return. I am just guessing the allocations above. I wonder is there is a better way to do this. Maybe a formula that will give me the recommended allocation to the expected withdrawal or expected average return throughout the years.

Thanks for the input