Have a large portion of one of my IRA's from 401k rollovers in American Fund mutual funds. These front loaded funds were purchased nearly 30 years ago and have done okay.

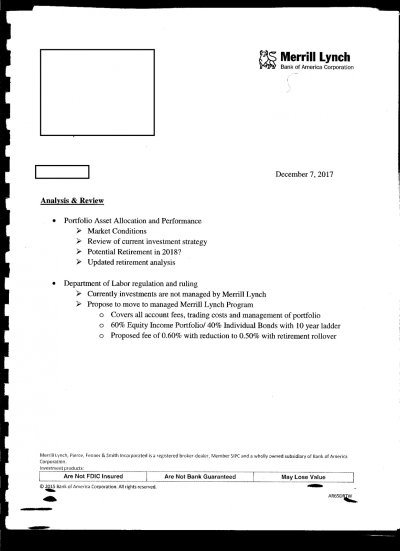

The dilemma I speak of has to do with not being able to trade within the American Funds as easy as it would be in say Fildelity, Vanguard or a Schwabb account since they "recommend" an adviser and they do not have in house advisers. The accounts are now held in my Merrill Lynch account and my adviser there has been very reluctant to help when it comes to discussions regarding trading within American Funds. They have offered me a "deal" at reduced fees in which I would have to liquidate my American Funds mutual funds accounts and transfer them into their own Portfolio Model in which I would need to turn over control and allow them to trade.

Ideally I would like to keep the American Funds mutual funds as an Investor Account and be able to re balance AA as needed going forward.

Has anyone or is anyone currently doing something like this within the American Fund Family.

The other option I have from standing pat - not preferred is to transfer all assets to Vanguard or Fidelity/Schwabb.

The dilemma I speak of has to do with not being able to trade within the American Funds as easy as it would be in say Fildelity, Vanguard or a Schwabb account since they "recommend" an adviser and they do not have in house advisers. The accounts are now held in my Merrill Lynch account and my adviser there has been very reluctant to help when it comes to discussions regarding trading within American Funds. They have offered me a "deal" at reduced fees in which I would have to liquidate my American Funds mutual funds accounts and transfer them into their own Portfolio Model in which I would need to turn over control and allow them to trade.

Ideally I would like to keep the American Funds mutual funds as an Investor Account and be able to re balance AA as needed going forward.

Has anyone or is anyone currently doing something like this within the American Fund Family.

The other option I have from standing pat - not preferred is to transfer all assets to Vanguard or Fidelity/Schwabb.