you will never see a spread sheet like this from your annuity provider . THIS IS THE REAL DEAL . basically all variable annuity's with guaranteed minimum growth rates work the same .

they would never let you see the bottom line growth rate you get on their guaranteed minimums and bonus bucks they give you .

here is an example of how these guaranteed minimums work and why what you think you are getting is not what you get .

this is actually not a bad products and as a proxy for cash it is actually pretty good.

it is called prudentials variable fixed income deferred annuity . it gives you a guaranteed 5-1/2% increases a year minimum or whatever your bond index that is linked got as a high water mark , which ever is higher .

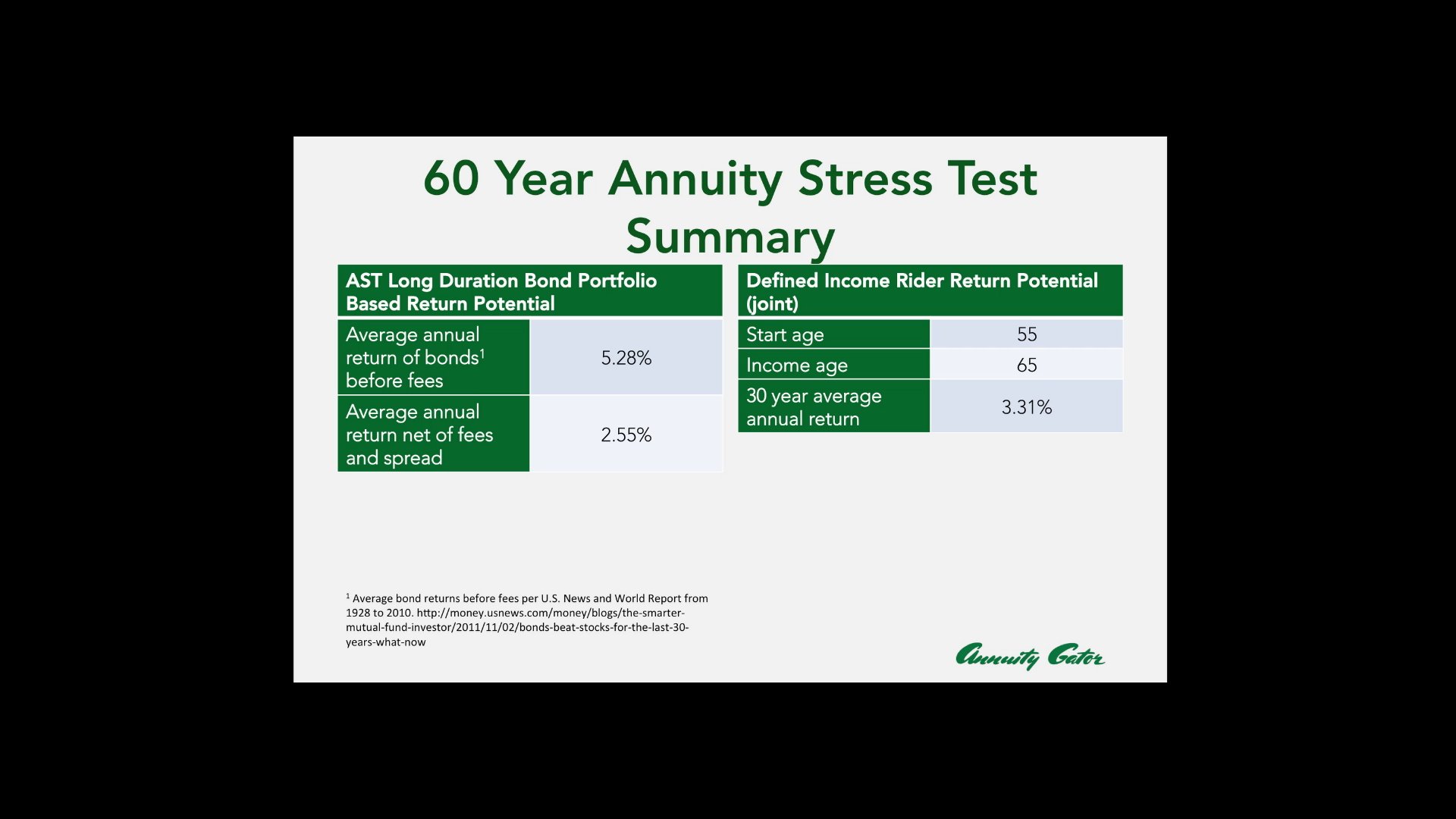

in reality there is no way a bond index today with more then 2-1/2 % in fees being charged is going to beat 5-1/2% so your guarantee is going to be your deal .

you will never see spread sheets like this from the annuity issuer . this is your real deal once the curtain is pulled back .

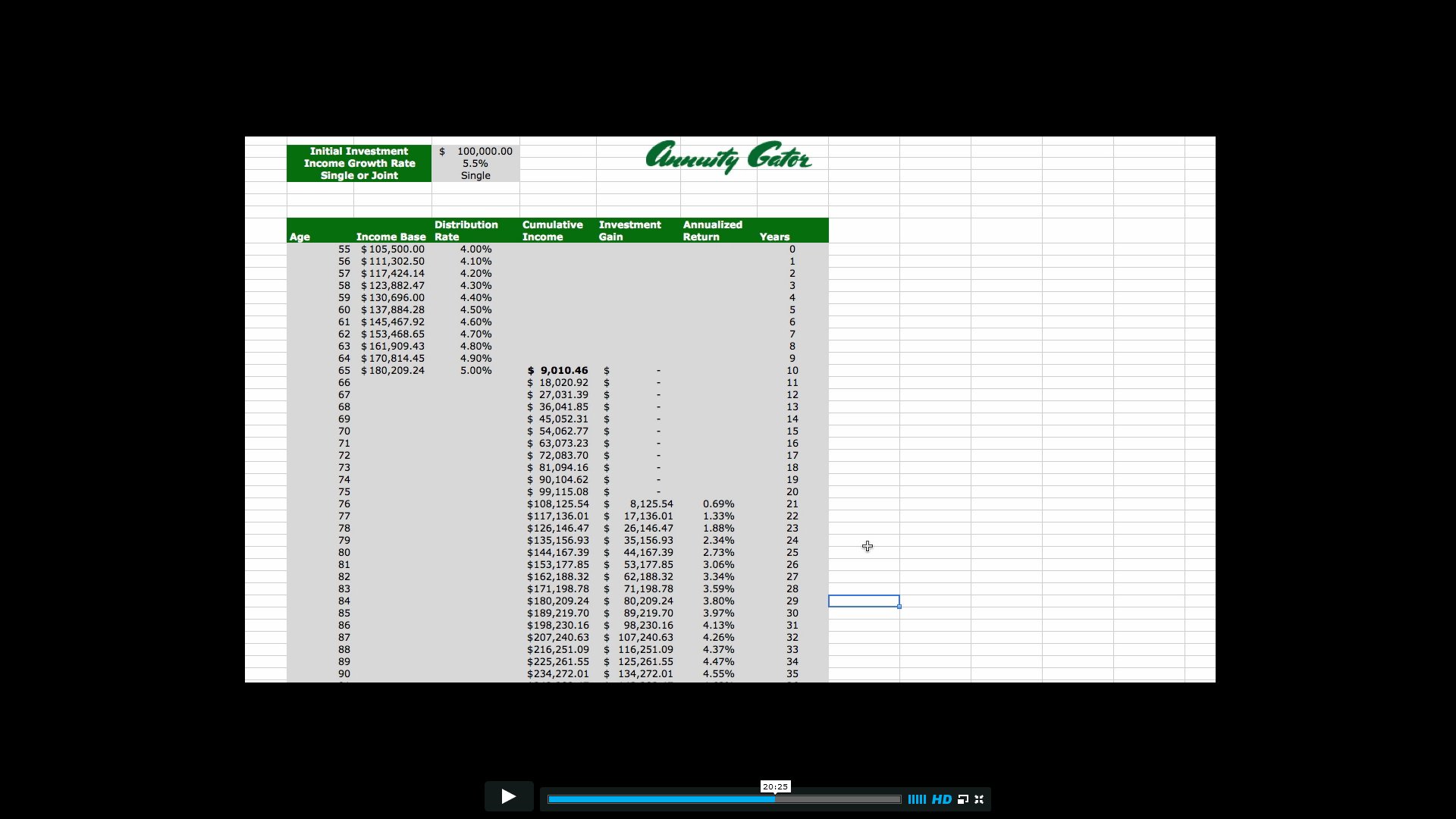

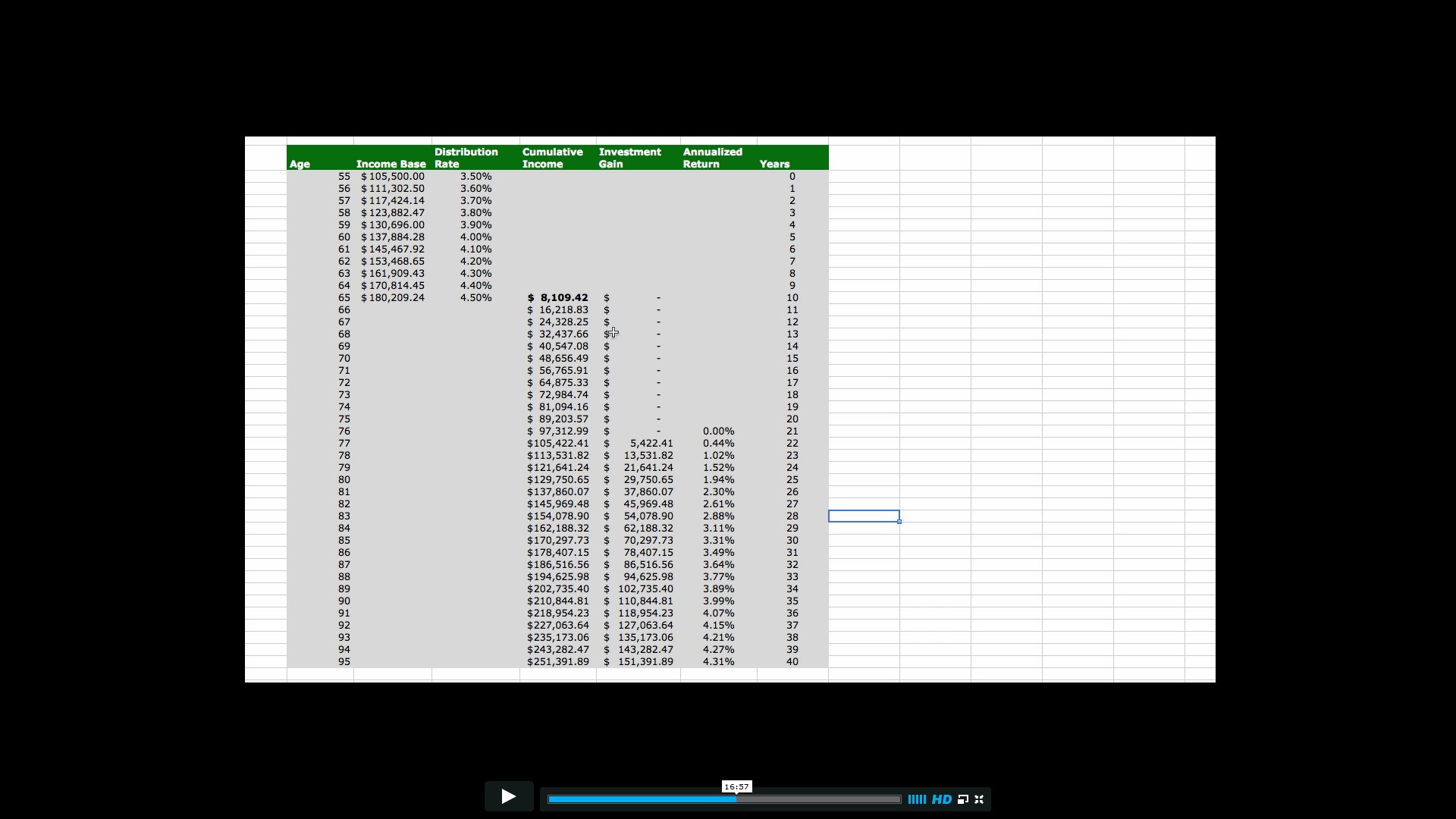

so here is a deferred annuity for a single , you start at age 55 putting money in and delay until age 65 when you annuitize your money .

the fees are 2.55% and you are linked to the ast bond index , similiar to AGG .

the guaranteed min of 5.50% includes the fees , the bond index does not , so right off the bat you know the link to the index is there because it sounds good but it will not beat the min with those fees .

so below you see the yearly compounding of the promised 5.50% . that is taking part in a sub account which you can never take out or pass to heirs . the balance is only used to compute your draw when you annuitize . your actual account value is the one linked to the bond index with all the fees .

that is what you get if you want your money or pass to heirs .

so you see if you give them 100k and take the annuity after year 1 ,you get 4% of 105k or 4200.00 bucks.

for every year you delay your balance grows by 5.50% and your draw if you annuitize goes up 1/10% so finally 10 years later you get 5% of 180k or 9k .

that is a nice jump in income so it isn't a bad product but if you thought that 180k was yours to take you were wrong . your actual balance is what is linked to the bond index net of all those fees .

you can see it takes until age 75 before you get all your money back and see dollar 1 on their dime .

NOTE , YOUR ACTUAL GROWTH RATE BY AGE 90 IS NOT THE 5.50% YOU THOUGHT , BUT ONLY 4.55%

not bad by todays standards but not what you expected .