Can he tell us when to get back in, or will that be in hindsight?

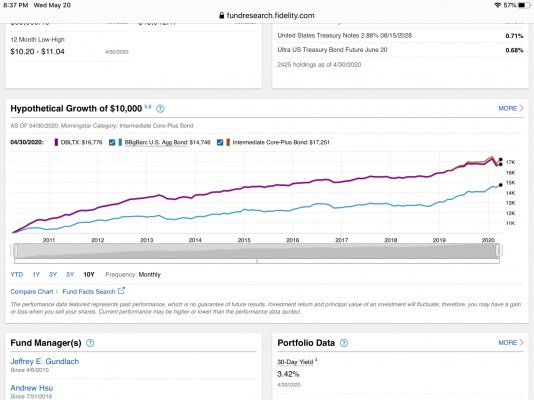

Recently Jeffrey Gundlach stated that he does not expect a V shaped recovery so he recommends increasing your cash allocation which I have already done since I am mostly in treasury bonds.

Warren Buffet sold his airlines stock recently so Warren Buffet has also increased his cash holdings.

The market is going up because the federal government is flooding the market with liquidity and the expectation of opening up the economy. However, this means the rally is debt based and we will not return to 100% normal in 2020 because of the uncertainty of the virus.

Once the 2nd quarter's corporate earnings are published in late July and August (which should be negative), I expect the rally to end. I believe that Jeffrey Gundlach and Warren Buffet have similar expectations.

Jeffrey Gundlach and Warren Buffet will likely NEVER tell you when to get back in since they both want the market to decline so that they both can buy equities at low prices using their increased cash position. After they have reallocate, only then they will recommend buying equities.

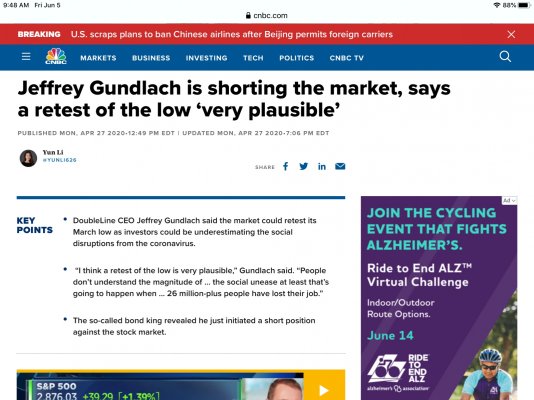

I pay more attention on what billionaires do rather than what they say. Jeffrey Gundlach is now shorting the market since he believes the PE ratio is too high (the E in earnings will diminish) so the market is be over-priced. A super high PE ratio generally do not cause the market to go up.

You should also remember that Bill Ackman shorted the market before the 2020 crash because he understood pandemic effect on the stock market. His 27 million dollar bet earned him 2.6 billion dollars in a few short months.

Billionaires are smarter than you think...which is why they are billionaires. This is why I pay attention to them.