Yes, thank you. That was my point. Interesting read.

I think the discussion here is maybe unnecessarily agitated because of a couple of non-obvious false premises. I include myself in being guilty of this:First, that an FA's sole purpose is to run the money. Several of those who use FAs have, I think, tried to draw attention to this fallacy, but with limited success.So, trying to avoid those two issues I'll try to restate my opinion on FAs:

Second, that all FAs are stock pickers or use stock picker mutual funds. I think this is largely true but certainly not universal. FAs approved to sell DFA funds, for example, are going to be well towards the passive side if not completely there. The Vanguard piece also argues for FAs doing passive investing, though we don't know how many have bought the argument.

If an FA does nothing but run the client's money and believes in stock picking, that is a bad deal for the client.

If an FA provides value to the client outside of just running the money, then that is an entirely reasonable thing for the client to pay for.

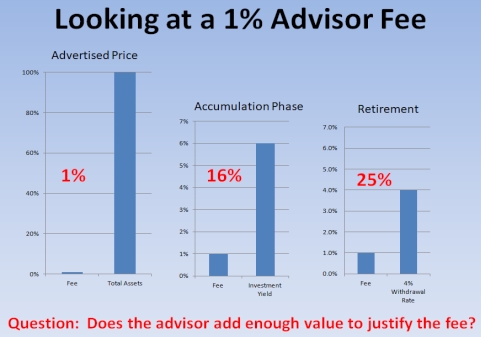

If an FA utilizes a stock picking strategy, he/she is statistically likely to cost the customer money versus a similar strategy (AA, etc.) that is passive. This extra cost (I have seen estimates of about 2-3%) is an additional cost of using that particular FA.

So the client simply needs to evaluate the net cost of the FA, including wrap fees and long-term investment performance, then decide whether the net cost is equal to or less than the value provided.

This is a much more balanced perspective that I agree with. One question though - where does the 2-3% estimate come from? If an FA is managing a portfolio that is mostly individual stocks, what costs are there other than the % of AUM fee and trading costs, if any?