Title is my question, in a nutshell.

I would really love to hear from those who are / have / will be retiring with less than 2M (1.5M - 2M), will be renting in retirement, and who have an unusually long retirement (45+ years) for any reason. In our case, our "retirement" includes our son's potential lifetime that will need to be funded by an inheritance from us as he is disabled and unlikely to support himself. The 1.5M - 2M figure at retirement comes from me assuming a 5% rate of return on our assets from this day until retirement.

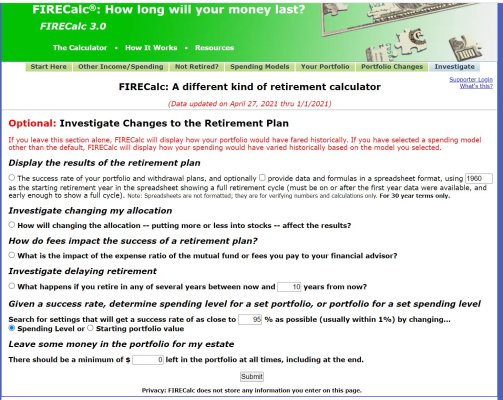

How do you plan to remain financially solvent for the entire time period? Is it possible / doable? I am assuming NO SS and NO pension.

The reason I don't factor in SS & pensions in retirement figure assumptions is because I tend to believe the persistent opinions voiced by folks around me (and on many Internet forums) that SS might be non-existent by the early / mid 2030-s and given that pensions are only as reliable as the employer paying them.

Are we the only ones in the difficult situation above? Thanks for sharing!

I would really love to hear from those who are / have / will be retiring with less than 2M (1.5M - 2M), will be renting in retirement, and who have an unusually long retirement (45+ years) for any reason. In our case, our "retirement" includes our son's potential lifetime that will need to be funded by an inheritance from us as he is disabled and unlikely to support himself. The 1.5M - 2M figure at retirement comes from me assuming a 5% rate of return on our assets from this day until retirement.

How do you plan to remain financially solvent for the entire time period? Is it possible / doable? I am assuming NO SS and NO pension.

The reason I don't factor in SS & pensions in retirement figure assumptions is because I tend to believe the persistent opinions voiced by folks around me (and on many Internet forums) that SS might be non-existent by the early / mid 2030-s and given that pensions are only as reliable as the employer paying them.

Are we the only ones in the difficult situation above? Thanks for sharing!