What would you do now of BND ?

What would you do NOW if you still have the etf form BND of the Vanguard VBTLF Total Bond Index.

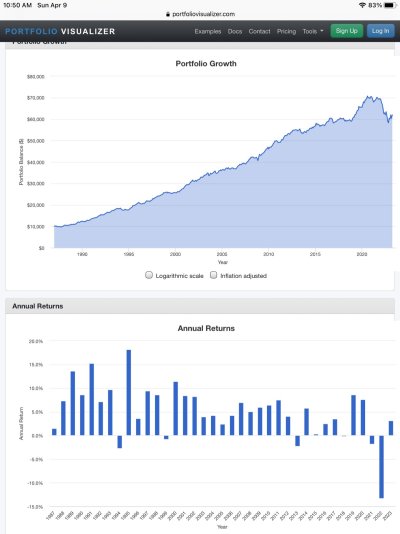

Yes, (was dumb enough) I did not exchange to another fund last year & BND was bruised by -13% in 2022.

I (was) am of the buy & hold category. I exchanged to buy some CDs, but still 80% of etf BND are still in our IRAs.

I did do Roth conversions of etf in our IRAs to hold VTI in our Roths.

Thankyou in advance.

What would you do NOW if you still have the etf form BND of the Vanguard VBTLF Total Bond Index.

Yes, (was dumb enough) I did not exchange to another fund last year & BND was bruised by -13% in 2022.

I (was) am of the buy & hold category. I exchanged to buy some CDs, but still 80% of etf BND are still in our IRAs.

I did do Roth conversions of etf in our IRAs to hold VTI in our Roths.

Thankyou in advance.

I'm already 75 so surely this setup will last longer than I do.

I'm already 75 so surely this setup will last longer than I do.