I am retiring soon, at the end of 2019, at age 59. Divorced, one adult child, living mostly independently.

Retirement assets consist of a mix of broad based stock and bond funds worth approximately $1.8M

Additionally, a pension of $1K/mo and Social Security at earliest age of 62 will be worth $2K/month.

Current employer will provide retiree healthcare, my cost will be about $180/month to start with.

Planning to live on expenses of +/- $70K/year in retirement.

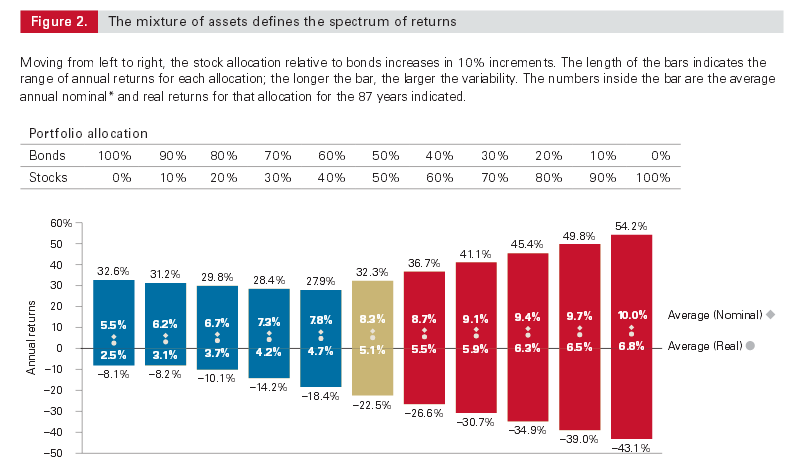

Current Asset Allocation is 50% stock funds/ 50% bond funds

I attempt to not be swayed too heavily by news and news of an impending economic downtown.

Nevertheless, I am concerned and considering changing my AA to 40% stocks/60% funds.

Any thoughts, advice or comments? Thank you!

Retirement assets consist of a mix of broad based stock and bond funds worth approximately $1.8M

Additionally, a pension of $1K/mo and Social Security at earliest age of 62 will be worth $2K/month.

Current employer will provide retiree healthcare, my cost will be about $180/month to start with.

Planning to live on expenses of +/- $70K/year in retirement.

Current Asset Allocation is 50% stock funds/ 50% bond funds

I attempt to not be swayed too heavily by news and news of an impending economic downtown.

Nevertheless, I am concerned and considering changing my AA to 40% stocks/60% funds.

Any thoughts, advice or comments? Thank you!