haha

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

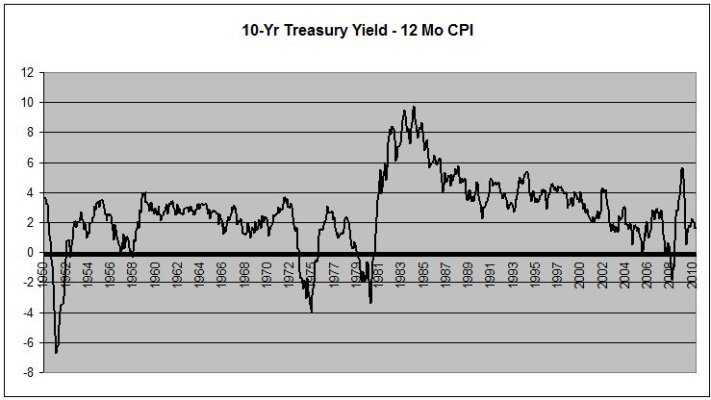

This graph says no, although the outcome over any given period will be dependent on the going-in I bond yield, and the yet to be known total return from stocks.

Series I Savings Bonds vs the stock market: US Savings Bonds

Ha

Series I Savings Bonds vs the stock market: US Savings Bonds

Ha