Midpack

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Nothing most haven't seen before.

There are no "right" or "better" choices, they're all viable - but not interchangeble. They are choices we're all confronted with like it or not...

There are no "right" or "better" choices, they're all viable - but not interchangeble. They are choices we're all confronted with like it or not...

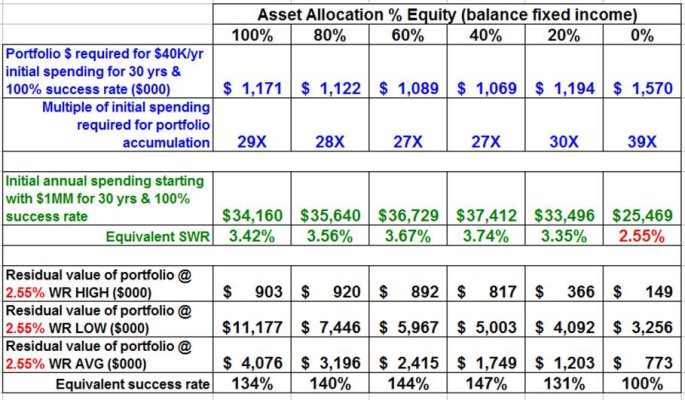

- It seem popular lately, so I used 100% success rate as indicated, which alters the results some might expect (most SWR studies typically assume 95% success).

- All based on 30 years.

- Assumes inflation adjusted spending after initial year.

- All generated using FIRECALC 1871-present, which includes 3 depressions, 20 recessions, 4 panic/bubbles (market shocks), 2 World Wars & 1 "Great Recession" 2008-09. List of recessions in the United States - Wikipedia, the free encyclopedia

- None of us can predict the future, and no calculator can or ever will. These historical tools are simply used as basis for planning. The user must factor in their own circumstances, outlook, risk tolerance, etc. and adjust accordingly. And even once the plan begins, we adjust our spending, reallocate assets, etc. as needed. We all hope to be pleasantly surprised, but we prepare for some downside of our choosing.

Attachments

Last edited:

I'd edit but that option is gone.

I'd edit but that option is gone.