TrophyHusband

Dryer sheet aficionado

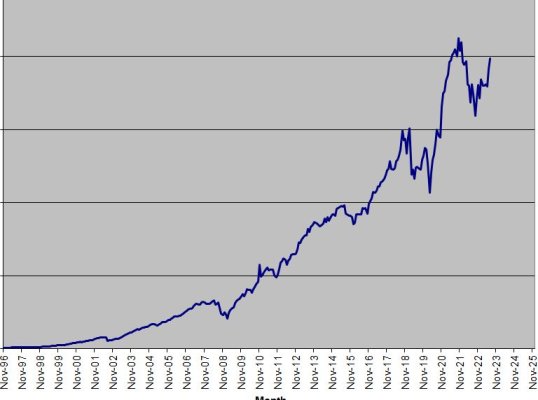

[MOD EDIT], my retirement portfolio peaked in Nov 2021. 2.5 yrs later and it still hasn't recovered.... and I'm not even retired. The longer this goes on, the further that retirement date keeps slipping further into the future.

Last edited by a moderator: