Midpack

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

I assume we'd all be happy if our $ portfolio never peaked (and that IS the goal for some who want to leave $ for family/charity), just increased year after year until we go poof.

So I am asking for those here for which a residual is not a primary goal, when do you actually expect your [-]NW[/-] nest egg to peak, maybe a 'guard rail' amount/range over time/age that would make you consider adjusting spending down or up.

I have always expected our [-]net worth[/-] nest egg to peak somewhere along the way and begin to decline. Some with a BTD approach may expect a peak at 65 yo. Others who plan to leave a big $ amount behind the peak goal is never. And some what me worry?

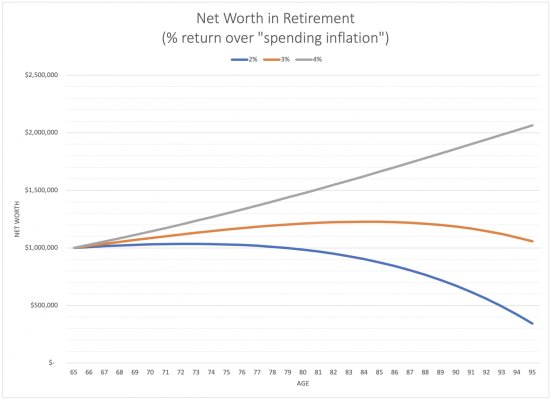

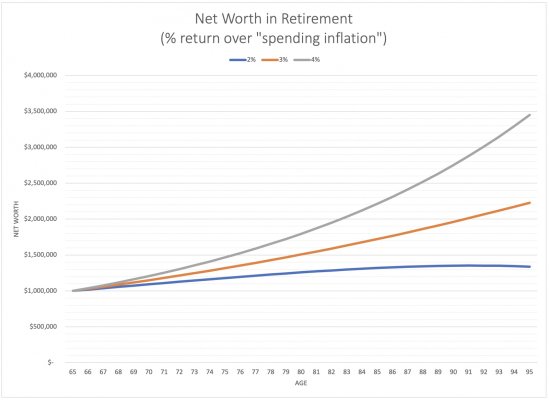

The chart is just a simple illustration for a 65yo 30 yr 4% withdrawal (inflation adjusted) [-]net worth[/-] SHD nest egg by age - purely theoretical. The 2% line is just returns that are 2% higher than annual spending increases (e.g. 5% returns with 3% spending increase).

Do you have some rough (or firm) $ waypoints that you're watching as the years pass?

So I am asking for those here for which a residual is not a primary goal, when do you actually expect your [-]NW[/-] nest egg to peak, maybe a 'guard rail' amount/range over time/age that would make you consider adjusting spending down or up.

I have always expected our [-]net worth[/-] nest egg to peak somewhere along the way and begin to decline. Some with a BTD approach may expect a peak at 65 yo. Others who plan to leave a big $ amount behind the peak goal is never. And some what me worry?

The chart is just a simple illustration for a 65yo 30 yr 4% withdrawal (inflation adjusted) [-]net worth[/-] SHD nest egg by age - purely theoretical. The 2% line is just returns that are 2% higher than annual spending increases (e.g. 5% returns with 3% spending increase).

- 2% peaks at age 73, 8 years into retirement

- 3% peaks at age 84, 19 years in

- 4% never peaks

Do you have some rough (or firm) $ waypoints that you're watching as the years pass?

Attachments

Last edited: