ABQ2015

Full time employment: Posting here.

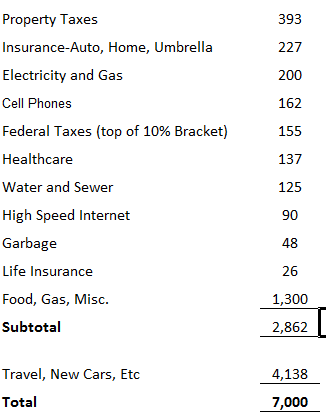

I get the spreadsheet thing. I've read Mr. Money Moustache and a couple of other blogs but never joined in. This is the first. It seems safe and it was dumb to ask for a spreadsheet. Some people post them, but I never believe them.

A few years ago there were threads on "how much did I spend in 201x?" generally in early January. Many posted spreadsheets with their expenses for the year - those who spent the least seemed most interested in posting. But I have not seen much of this lately. You may want to dig around and find those old threads.