ERD50

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Seems I've heard recommendations from some here, that one could/should be conservative in their AA for the first 5 years, because the failing scenarios hit that bad sequence of returns in the early years. You get hit, and it is hard to recover.

That never felt right to me, seemed more like market timing. And so what if that bad stretch hit you after the first 5 years? Wouldn't that be just as bad? Especially because those bad drops are preceded by a run up that would have been missed.

But I wasn't sure how to test the idea. Then I came up with this, using that portfolio analyzer site. Now I know people will say this is cherry-picked data, but I think it stands as an illustration.

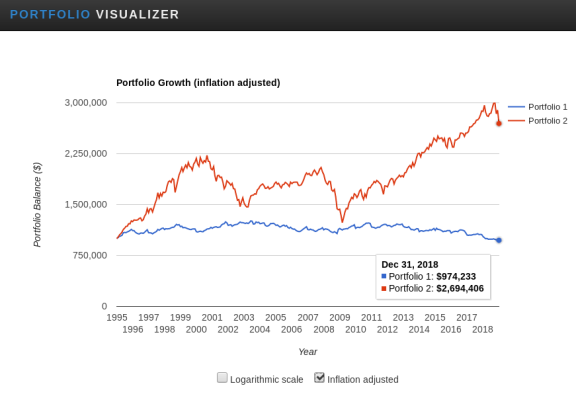

So imagine two people ready to retire. They have just seen the market double in the last 5 years, and they both are a bit nervous that it is poised for a drop. Retiree "STC" decides to stay the course with a 70/30 AA, retiree "B" goes to 100% bonds. They both have $1M and will start with a 3.5% WR, adjusted for inflation each year.

The year is 1995. The market rises for another 5 years. Does "B" decide he's missed out on too much, time to join in (just in time to get clobbered!)? Or is he more convinced of future drops, and sticks with 100% bonds? Either way, "B" never catches up to "STC" - though they are at about the same point for a brief period at the bottom of the 2nd drop, FEB 2009.

By end of 2018, STC's portfolio has risen to $2,694,000 while B's portfolio has lost buying power, down a bit to $974,000 (both numbers shown as reduced by inflation).

https://goo.gl/vJtsAL (select "Infl Adj" under graph)

I'm sure different start years would show an advantage for being conservative, but that really just seems to demonstrate market timing to me. Like I said, after a 5 year run up, most of us would be thinking a correction is coming. Sometime. But when?

Portfolio 1

VBMFX Vanguard Total Bond Market Index Inv 100.00%

Portfolio 2

VFINX Vanguard 500 Index Investor ........ 70.00%

VBMFX Vanguard Total Bond Market Index Inv 30.00%

-ERD50

That never felt right to me, seemed more like market timing. And so what if that bad stretch hit you after the first 5 years? Wouldn't that be just as bad? Especially because those bad drops are preceded by a run up that would have been missed.

But I wasn't sure how to test the idea. Then I came up with this, using that portfolio analyzer site. Now I know people will say this is cherry-picked data, but I think it stands as an illustration.

So imagine two people ready to retire. They have just seen the market double in the last 5 years, and they both are a bit nervous that it is poised for a drop. Retiree "STC" decides to stay the course with a 70/30 AA, retiree "B" goes to 100% bonds. They both have $1M and will start with a 3.5% WR, adjusted for inflation each year.

The year is 1995. The market rises for another 5 years. Does "B" decide he's missed out on too much, time to join in (just in time to get clobbered!)? Or is he more convinced of future drops, and sticks with 100% bonds? Either way, "B" never catches up to "STC" - though they are at about the same point for a brief period at the bottom of the 2nd drop, FEB 2009.

By end of 2018, STC's portfolio has risen to $2,694,000 while B's portfolio has lost buying power, down a bit to $974,000 (both numbers shown as reduced by inflation).

https://goo.gl/vJtsAL (select "Infl Adj" under graph)

I'm sure different start years would show an advantage for being conservative, but that really just seems to demonstrate market timing to me. Like I said, after a 5 year run up, most of us would be thinking a correction is coming. Sometime. But when?

Portfolio 1

VBMFX Vanguard Total Bond Market Index Inv 100.00%

Portfolio 2

VFINX Vanguard 500 Index Investor ........ 70.00%

VBMFX Vanguard Total Bond Market Index Inv 30.00%

-ERD50