target2019

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

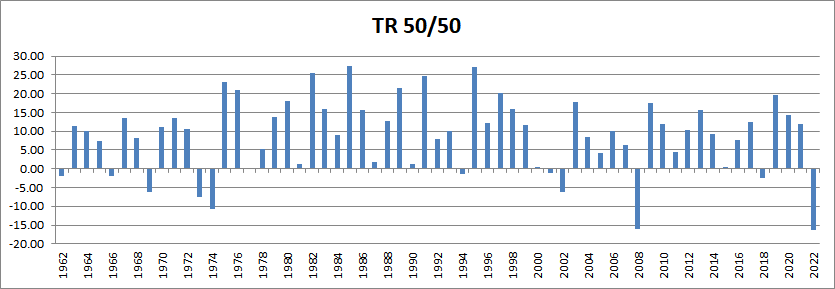

Expecting bond funds to offset equity losses in a 50/50 portfolio?

When I examined data from the Backtest-Portfolio workbook, using TSM and TBM synthesized data, that did not happen in 11 out of 60 years.

If you use shorter term bond funds, I think there would be more failures.

What you are experiencing is the end of a long bond cycle coupled with high inflation.

When I examined data from the Backtest-Portfolio workbook, using TSM and TBM synthesized data, that did not happen in 11 out of 60 years.

If you use shorter term bond funds, I think there would be more failures.

What you are experiencing is the end of a long bond cycle coupled with high inflation.