USGrant1962

Thinks s/he gets paid by the post

Per this article: https://www.cnbc.com/2020/06/21/ban...-in-deposits-since-coronavirus-first-hit.html

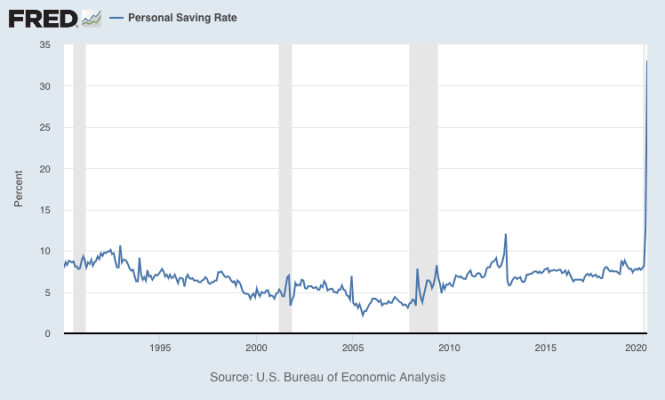

$2 trillion has been deposited in banks since January. "The personal savings rate hit a record 33% in April..." and "Personal income actually climbed 10.5% that month..." from stimulus checks and unemployment benefits. "...checking accounts below $5,000 in balances actually had up to 40% more money in them than before the pandemic."

Looking at the source, the flow flattened out in May/June, but banks are still sitting on $2.5T more assets than in January.

https://www.federalreserve.gov/releases/h8/current/ See Table H.8; Page 3, line 33 for $B.

Obviously spending has been down sharply. To me, this means bank account interest rates will continue down, and eventually much of this cash will be spent or moved into stocks and bonds.

$2 trillion has been deposited in banks since January. "The personal savings rate hit a record 33% in April..." and "Personal income actually climbed 10.5% that month..." from stimulus checks and unemployment benefits. "...checking accounts below $5,000 in balances actually had up to 40% more money in them than before the pandemic."

Looking at the source, the flow flattened out in May/June, but banks are still sitting on $2.5T more assets than in January.

https://www.federalreserve.gov/releases/h8/current/ See Table H.8; Page 3, line 33 for $B.

Obviously spending has been down sharply. To me, this means bank account interest rates will continue down, and eventually much of this cash will be spent or moved into stocks and bonds.