I am new at this and just making sure I understand this correctly as I am starting to think about retirement.

• I would like to retire at age 60 (I am 54 now)

• I will be living off of $70K per year once I retire

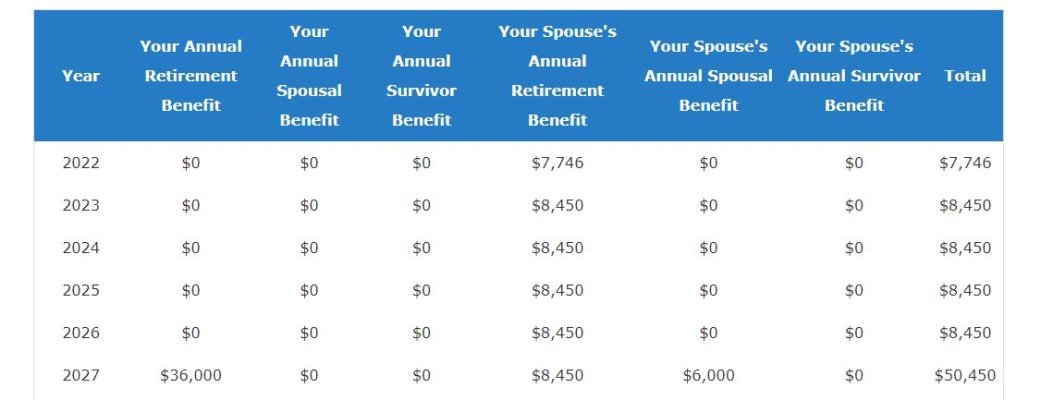

• My social security benefits will be at age 65 (when I plan on starting to take out) $2,676 per month

• My wife has never worked (homemaker). She gets half that amount I have read (I hope that is right), and is the same age as me $1,335)

• That means combined our social security comes to $48,132 per year.

• So in short I need enough cash on hand to carry me from 60 to 65 (350K) and then an additional $21K per year to bridge the gap between social security and that 70K target.

Do I have this right?

• I would like to retire at age 60 (I am 54 now)

• I will be living off of $70K per year once I retire

• My social security benefits will be at age 65 (when I plan on starting to take out) $2,676 per month

• My wife has never worked (homemaker). She gets half that amount I have read (I hope that is right), and is the same age as me $1,335)

• That means combined our social security comes to $48,132 per year.

• So in short I need enough cash on hand to carry me from 60 to 65 (350K) and then an additional $21K per year to bridge the gap between social security and that 70K target.

Do I have this right?